Tenant Payment Performance Update through May 2022

We’re not aware of any other local management company sending their clients these type of updates! Please let us know if you hear of another company doing so.

Please be sure to share this with anyone you know interested in real estate investing or looking for a better property manager, so they can see what they are missing!

LANDLORD UPDATES

Evictions are still a challenge in many parts of the USA for landlords. Many politicians, eager to gain favor with voters, continue to blame landlords for the majority of the problems with tenants not being able to afford rent.

Example: A bill introduced in New York state would place limits on landlord’s ability to increase rents. The article claims access to adequate housing is a human right.

Why are landlords being blamed for market supply & demand issues?

Landlords need to monitor these political developments and consider political contributions for candidates that are not so pro-tenant.

EVICTIONS UPDATE

In the past week, we’ve had 3 nonpaying Detroit tenants removed by bailiffs!

The 36th District Court in Detroit is still behind 2-3 months, but our persistence usually pays off. Unfortunately, the judges are still heavily biased towards tenants, but our usually meticulous documentation helps push past that. We are still getting 2-month adjournments on some cases, but overall we’re seeing slow improvement.

Outside of Detroit, most of the courts aren’t as tenant-friendly and are moving faster. As an example, we took over a portfolio of Pontiac properties at the end of March. Sent eviction notice to tenant April 6th, sent to attorney April 18th, and received a court date on April 22nd. Unfortunately, the court is not until August 3rd, but we did get it fairly fast.

GOVERNMENT AID FOR PAST DUE TENANTS

We’re now getting 2nd rounds of CERA funds for many tenants and even got our first 3rd round last week.

We’re worried that many of these tenants have already decided they won’t pay rent when the CERA funds run out. So, the question then becomes, when do we decide to evict them as opposed to continuing to chase CERA funds? It’s easier to RentReady a property and find a new tenant in spring/summer as opposed to fall/winter time of the year.

TENANT APPLICANT SCREENING CHALLENGES

Application fraud continues to increase. Tenants that chose not to cooperate & communicate with their landlords during the Eviction Moratorium and are now being evicted are finding it difficult to get approved for a new rental home. Desperate people do desperate things, so many of these tenants are frauding their applications to get approved.

Due to concerns about being accused of Fair Housing discrimination, and getting sued, we have to proceed carefully with every application we receive. As a result, it’s taking us longer to process each application.

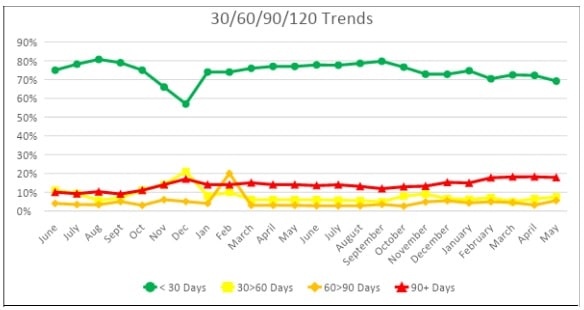

RENT PAYMENT TRENDS 30-60-90+ Days Behind

30-day lates declined again last month, while 60-day & 90-day lates increased slightly. 120+ lates were unchanged.

We’re probably going to see improving numbers in the coming months as we evict more and more nonpaying tenants.

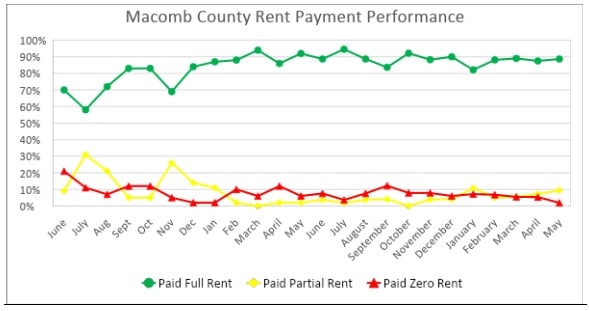

Macomb County: All the metrics improved last month! We’re looking forward to this trend continuing.

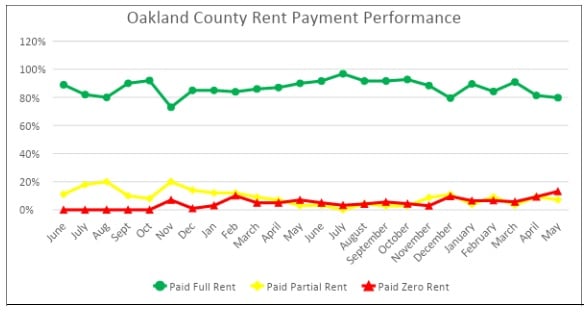

Oakland County: The portfolio of Pontiac properties we took on in March continues to worsen our metrics as time goes on and we work with them to start paying, agree to Payment Plans or we start the eviction process. That portfolio aside, our metrics improved.

Wayne County: We took on another nonperforming apartment building and a nonperforming portfolio, which are negatively affecting our metrics. Apart from those, we saw slight gains in the zero-rent metrics due to finally being able to evict several non-performing tenants.

Miscellaneous

A disturbing trend is starting to appear across the country. With rents increasing faster than incomes, many tenants are signing leases they can’t really afford. This is leading to an increasing number of payment defaults on leases within the initial 3 months.

One of the reasons these tenants are being approved for leases they can’t afford, is the antiquated methods most Property Management Companies (PMC) use to qualify applicants. They approve applicants if they have income equal to 3 times the rent amount. This method, while easy, ignores all other debt payments (car & student loans, etc.).

We’ve always used the more robust Debt-To-Income (DTI) method used by the mortgage industry, which takes into account all debt payments an applicant has. Additionally, instead of using income from just one paystub, we average income over a minimum 12-month period whenever possible, for a more stable income amount. While the method we use won’t address 100% of this challenge, it will help us avoid a high percentage.

Again, please refer us to others you know interested in real estate investing or that are looking for a better property manager!