Tenant Payment Performance Update through January 2023

We’re not aware of any other local management company sending their clients these types of updates! Please let us know if you hear of another company doing so.

Please be sure to share this with anyone you know interested in real estate investing or looking for a better property manager, so they can see what they are missing

EVICTIONS UPDATE

We’re seeing progress with the City of Detroit’s 36th District Court getting caught up on evictions as we executed 4 evictions last month and were also granted 3 more Writs.

This month we’re looking forward to executing the 3 Writs we have and getting another 20 Writs we have in the process signed, so we can get rid of nonpaying tenants.

Many nonpaying tenants are starting to realize they will soon be evicted and are getting desperate. Some are trying to convince eviction judges to grant them more time in their homes, claiming their income tax refunds will be used to pay off their past-due rents. We believe most of them are planning to actually use these funds to find a new home and NOT pay anything on their past due balances. Some are desperately contacting us for Payment Plans, but are not cooperating with our requirements – which tells us they’re not serious about paying or may not even have the ability to pay.

Many of these tenants are just desperate to stay longer for free and will tell us anything they think we want to hear to make it happen. Some have offered Payment Plans that will take years to pay off their past-due balances. Others want owners to settle for low percentages of their balances.

We do try to continue to work with ALL these tenants, but they must meet our requirements.

GOVERNMENT AID FOR PAST-DUE TENANTS

CERA has ended, and Michigan shut down the CERA application website on June 30. We’ve been informed by numerous sources that CERA is paying out their final cases. We were able to receive 4 CERA checks in January. However, we noticed that with other CERA cases in progress, judges are signing off on judgments and are not allowing tenants to use CERA as an excuse to have the case adjourned.

We have noticed that the organizations processing CERA applications and disbursing funds are giving the runaround when it comes to disbursing the funds. Also, it is becoming a challenge to receive the escrow funds. We have noticed that the agencies are not giving extensions like they used to. Unfortunately, that is setting up owners for failure as if an owner wants to obtain the CoC it takes the city about 90 days to even go to the home to do the initial inspection to obtain the list of repairs needed by the city.

As CERA ends and evictions are actually happening, more and more tenants are moving instead of making any attempt to pay off their past-due balances. We’ve started calling these, “Eviction Bankruptcies”.

TENANT APPLICANT SCREENING CHALLENGES

In addition to increases in fraud, we’re also seeing new and creative fraud ploys.

Here are some of the issues, we sometimes spend hours trying to validate, to keep from renting to bad tenants:

- Fake Landlords to Hide Poor Rental History – Typically a family member or friend.

- Fake Addresses to Hide Evictions Started – Courts are catching up on their backlog of eviction cases and tenants know their eviction will show up on their background checks. So, they are trying to move BEFORE an eviction judgment is entered by lying about where they live. Often, they claim they are living with a relative or friend.

- Fake Addresses and/or Landlords to Hide Past Due Rent – Legal Aid attorneys try to force many owners to accept Conditional Dismissals for eviction cases to get CERA funds. This avoids an eviction judgment being awarded and showing up in public records that background checks then pick up.

- Fake Paystubs & Jobs – We’re still seeing these, but not as often as during the COVID lockdown.

Due to concerns about being accused of Fair Housing discrimination, and getting sued, we have to proceed carefully with every application we receive. As a result, it’s taking us longer to process each application.

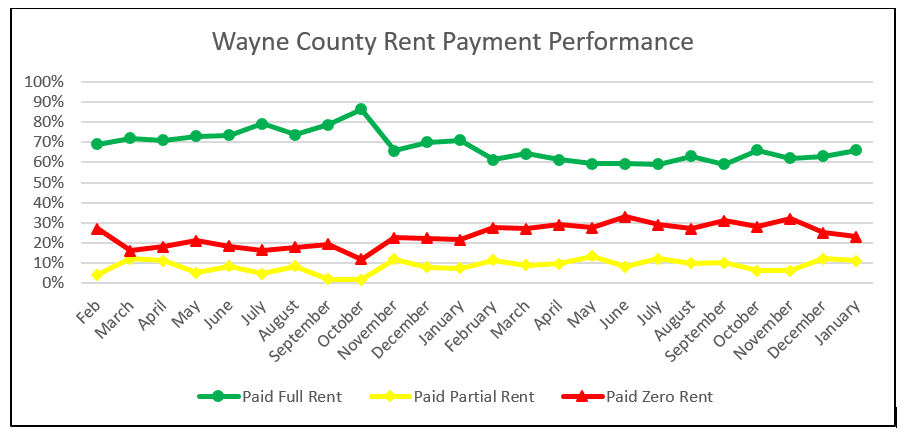

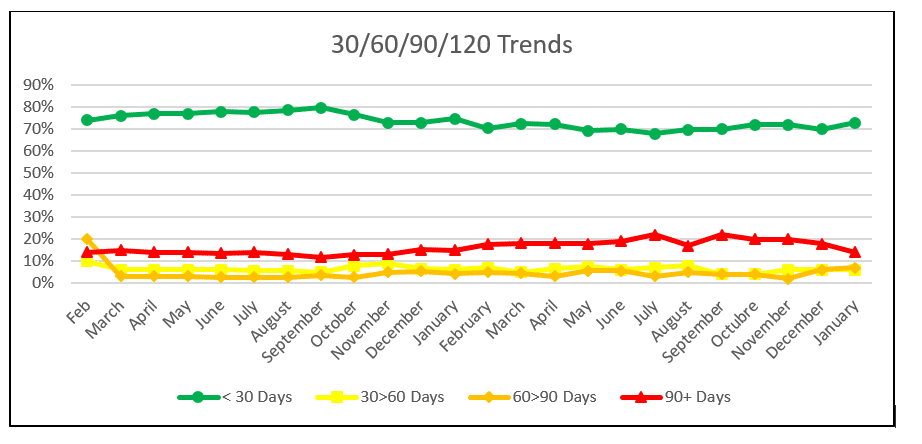

RENT PAYMENT TRENDS 30-60-90+ Days Behind Update

We have seen improvements. As you can see the number of tenants that are not paying anything has dropped as more tenants are paying partial or full rent.

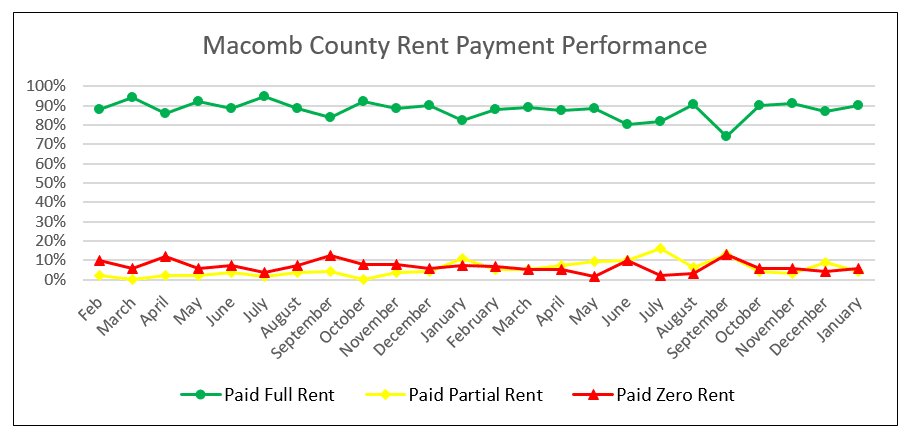

Macomb County:

As you can see, the number of tenants paying full rent slightly increased as tenants have tried to pay off the full rent.

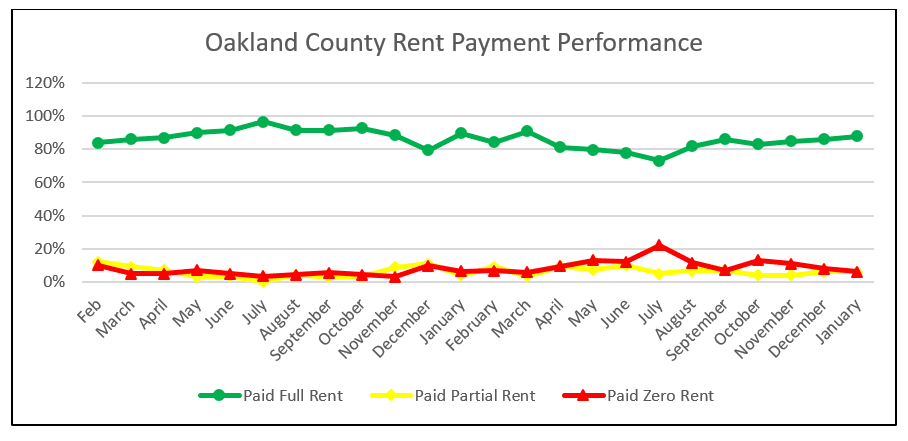

Oakland County:

The number of tenants paying full rent is increasing. We were able to get rid of some of the tenants who were not paying any rent and replace them with paying tenants. As you can see, our numbers have improved.

Wayne County:

Wayne County, specifically Detroit, has always been our biggest challenge due to the high percentage of tenants living paycheck-to-paycheck. However, with the courts catching up on evictions, and tenants seeing that reality, we are starting to see tenants paying full rent while we also start to really evict the stubborn non-payers. As you can see, the number of tenants paying 0 rent has decreased as we have been able to execute evictions.