National Rents are Declining Everywhere. How Is the City of Detroit Affected by this Trend?

According to a recent study, rents have declined in almost every major US city in 2023. This downward trend is especially apparent in metro areas such as Los Angeles and Las Vegas, where rents

Here’s a snapshot of the headlines that made the news:

While renters rejoice in the lower monthly rent prices, the trend may not be good news for everyone. For landlords and investors, a decrease in rental costs could mean a reduction in profits. If you’ve invested in the City of Detroit, you may wonder how this trend affects rents in the city.

Unfortunately, it’s difficult to say for sure. The data on rent prices in the City of Detroit is somewhat limited, and the available information is often conflicting. But we’ve done our best to understand the released data. Read our keynotes below.

Average Rent Declines in Major US Cities Mid-2023

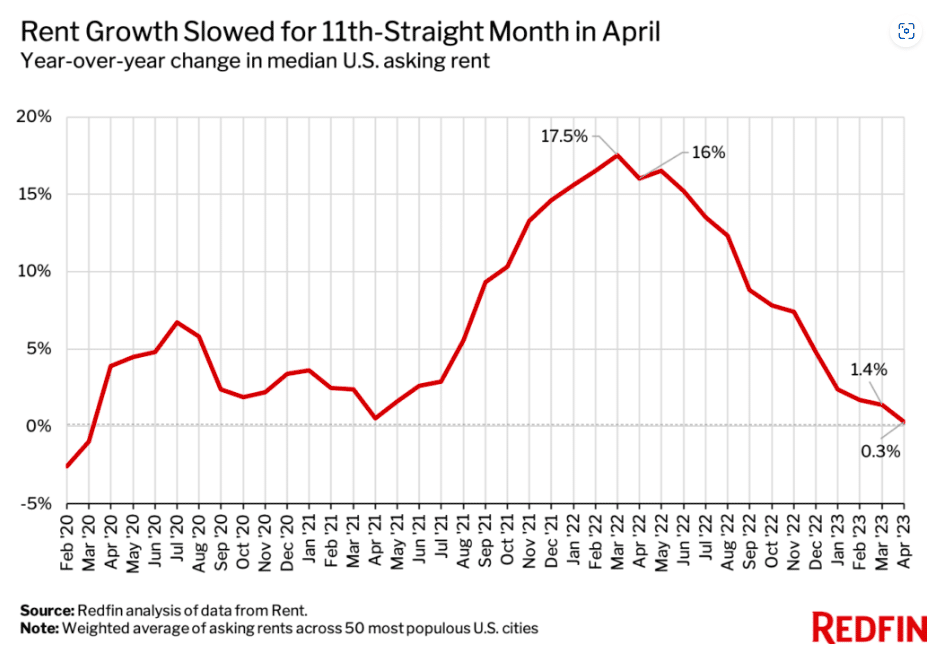

Redfin reported that the national average rent price was up 0.3% year-over-year in April 2023. However, it’s the 11th consecutive month that the median rent price shows slow growth. The slow growth is even more apparent when compared to past trends. For example, the rent increased by 16% during the same period last year.

Even if we look at the data on a monthly growth basis, the median rent decreased by 0.2% month-on-month, which is unusual given that rents typically increase during this period:

Deputy Chief Economist at Redfin, Taylor Marr, said, “The balance of power in the rental market is tipping back in tenants’ favor as supply catches up with demand. That’s easing affordability challenges and giving renters a little wiggle room to negotiate in some areas.”

In other words, as homebuilders continue to construct more properties to supply the growing demand for apartments, renters have more power to negotiate lower rental prices.

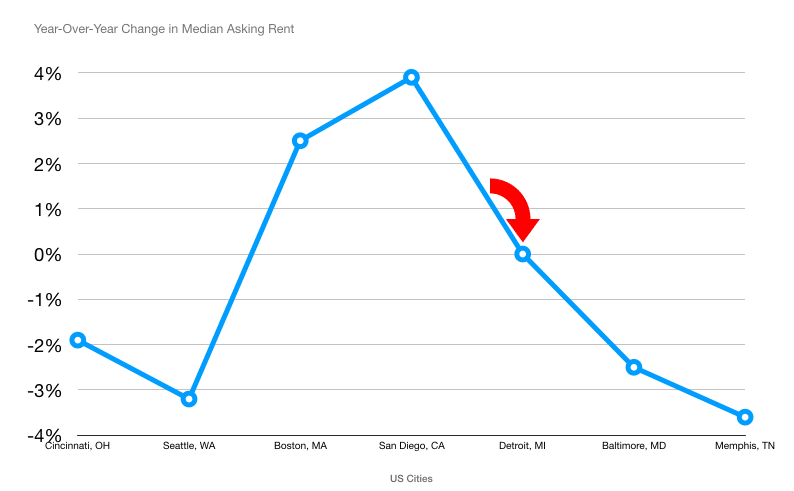

If we look at the Top 50 most populous areas in the US, many cities saw a decline in the rent average. Here’s a snapshot to better visualize that trend:

The City of Detroit, while being one of the most populous US cities, shows a good YOY change in median asking rent—it’s flat. So, for investors, this is good news because the rental prices didn’t decline. Still, it also didn’t increase. So, let’s look at the details of the Detroit housing market movements.

Recent Rent Trends in the City of Detroit Housing Market

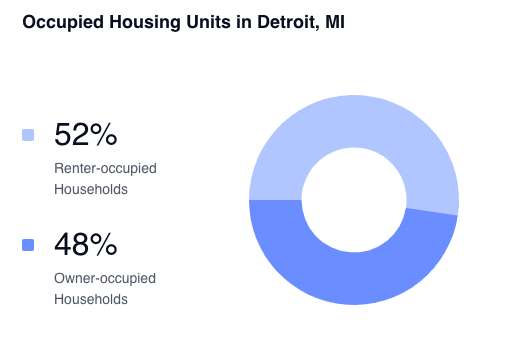

The City of Detroit is known for its affordable housing stock. Yet, residents still can’t afford to purchase a property, and they struggle to meet mortgage criteria (e.g., good enough credit score and income to qualify). As a result, they have no choice but to rent, which pushes rent prices up.

In fact, it costs 24% more to rent in Motor City than it does to buy it—the highest rent premium versus 50 of the most populous metro areas, according to Redfin. And the homeownership rate in the City of Detroit is only 51% compared to the national rate of 66%, which means there’s a larger tenant pool.

You can expect that more and more Detroiters will continue to rent because they don’t have the financial freedom and good credit score to purchase a property. As a result, the high demand for rental properties allows you, as an investor, to charge a premium for your rental properties. And this is a perfect deal because you can purchase a property for a cheaper value and set a high rental price. You can further maximize this financial opportunity by investing in an up-and-coming neighborhood where home values continuously rise, giving you higher equity and appreciation gains.

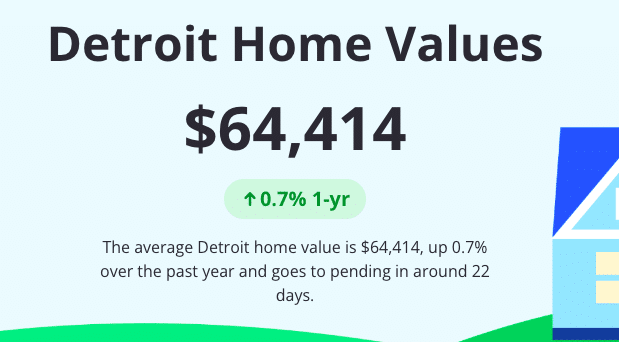

When it comes to property values, the City of Detroit is experiencing positive growth as it increased by 0.7% YOY. This is also great news for investors and landlords because you can increase your cash flow from renters while enjoying appreciation gains from property values. While Detroit property values aren’t keeping pace with the national average, they have certainly shown improvement since the Great Recession, and the growth shows no indication of stopping any time soon.

However, even if it all sounds great, there are many considerations that you should take note of.

First, given that Detroit residents might struggle with their finances, you must screen your tenants thoroughly. Here are some factors to consider when screening tenants:

- Meet a good rent-to-income ratio

- Good educational attainment

- Stable income and employment

- Stellar references from past landlords

To learn more about how to screen tenants effectively and adequately, check out our Deep Dives and past articles on tenant screening and criteria.

Secondly, recent news revealed that the mayor of the City of Detroit is looking to support homeownership by planning assistance programs and lower property taxes to help first-time homebuyers. For example, the city might soon implement a land value tax, where the government will redistribute a portion of the collected rent from property owners back to the renters.

The proposed reform will only help renters on the cusp of affording a property, but it may lessen your tenant pool of quality renters. These renters are those that you want to target because they can pay high rent prices as they’re financially stable enough that they only need a little help from the government until they can purchase a property of their own.

More than that, the proposed land value tax will encourage more rental units, which is terrible for your business because there’s a possibility that the average rent prices will decrease as renters will have more rental properties to choose from.

Nonetheless, the new policy is not all bad. Once the government implements the land value tax, it will support the City of Detroit’s economic growth, which in the bigger picture, is positive for investors. A healthy economy will boost property values (more appreciation gains) and encourage more people to move into the city (more renters and better cash flow).

So, the housing market trends of Metro Detroit show that it’s an excellent place for investors looking to convert properties into rental units. In fact, we checked recent statistics and found the following updates:

- The City of Detroit continues to have affordable properties where the average home price is $237,575—a price 8% below the national average of $343,292. Therefore, buyers have more opportunities to find a great deal for properties.

- The average rent for a one-bedroom Detroit apartment is $1,025—a 1% drop compared to a year (June 2022). But for a two-bedroom home, the median rent is $1,150 with a 10% year-over-year change.

- Detroit’s unemployment rate dropped to 5.8% in March 2023, the lowest in 23 years. According to Detroit Mayor Mike Duggan, the drop reflects more job opportunities for Detroiters. This is good news because the number of renters with stable jobs and income increased.

Still, Detroit investors like yourself might be charging rent locals can’t afford. Charging high rent is useless if they can’t pay the payments. So, we suggest that you ask yourself the following questions:

- Are you charging above neighborhood rent averages?

- Are your tenants struggling with rent payments?

- Are they paying on time and in full?

If you secured financially stable and responsible tenants, they probably aren’t struggling with rent. But if the economy’s downturn caused your tenants to lose their jobs (which is common if you have lower-class tenants), you might need to help them out in fear of losing occupancy.

However, the adage that The City of Detroit is still a landlord’s market remains true, where renters have the blunt end of the stick.

But your cash flow and returns rely heavily on your tenant’s financial capability. As much as you might like to charge high rent prices, you won’t reap anything if renters can’t afford your homes in the first place.

Adapting to Detroit Market Shifts

Thankfully, the overall Metro Detroit is still a landlord’s market, despite the shifts. Rent prices remain on the side of investors, presenting an opportunity for those willing to lower their rent prices to attract quality tenants—although doing so requires careful screening.

Thoroughly evaluate your tenants, keep an eye on market movements, and your rental properties should remain profitable. Your goal is to have high occupancy rates from responsible tenants, the best possible returns from your investments, and thus, adapt to any market shifts that might occur.

Do you need more help in navigating the Metro Detroit market?

Our team is a localized, expert property management company that’s been operating in Metro Detroit for over two decades. We’ve experienced and succeeded in more market shifts than you can imagine—give us a call and we’ll help you in your investment journey.