Landlords: Accounting 101: Understanding the Numbers in Rental Properties

One small mistake with your rental property accounting can lead to big consequences.

Forget to collect rent on time, or at all? You lose revenue.

Don’t have a proper record of your maintenance fixes? Your budget is suddenly overrun, or you can’t claim tax deductions.

Overlooked paying for HOA fees? You’ll have to pay a hefty fine.

The list goes on.

There are a lot of responsibilities when it comes to accounting for your rental properties. The good news is, that we’re breaking down the basics for you today to help you keep your finances in order.

Accounting 101 for Landlords

Here are a few things you should take into consideration to get yourself started with accounting for your rental properties.

Setting up your Bank Accounts to Different Buckets

It’s a good financial practice to spend and save your money only for its intended purpose. That means don’t mix up the use of your rental income with your personal expenses. With this in mind, the first rule of landlord accounting is to keep your personal account and rental property account separate.

And in the same vein, earmark additional accounts for specific use. Think of them as buckets. For example, create a business account for the sole purpose of receiving rental income. You could also create one account for Property X, and another for Property Y. Many states also require tenant security deposits to be kept in their own account.

Then, set up separate accounts for your fixed and variable costs, too. Make separate expense accounts for maintenance, property taxes, etc. With whatever’s left, you can create another account for a reserve emergency fund or even a separate investment fund for your next rental property.

Streamline your Rental Collections

In practice, the landlord sets the terms and manner in which a tenant pays. It’s your property, so it’s your rules!

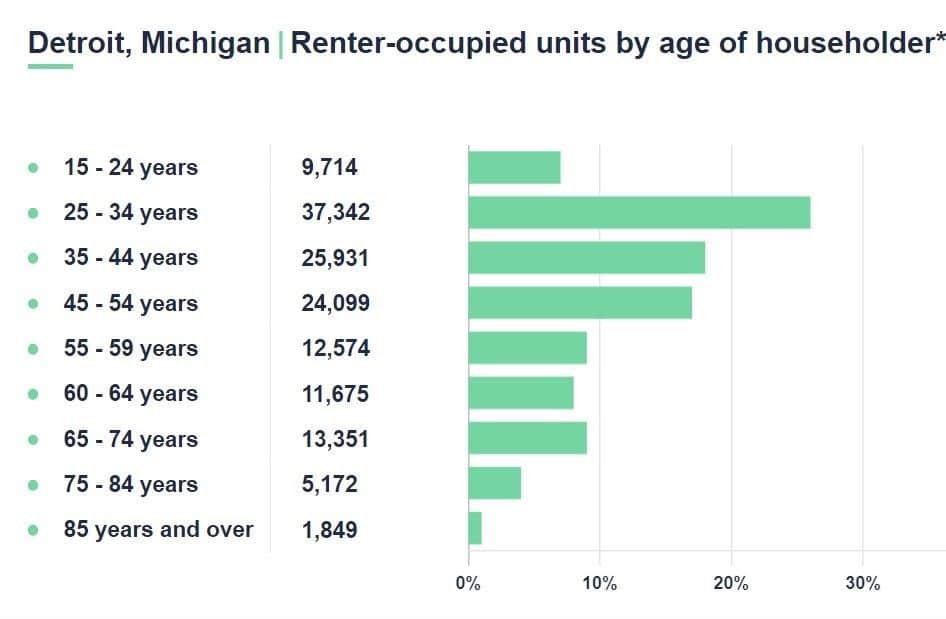

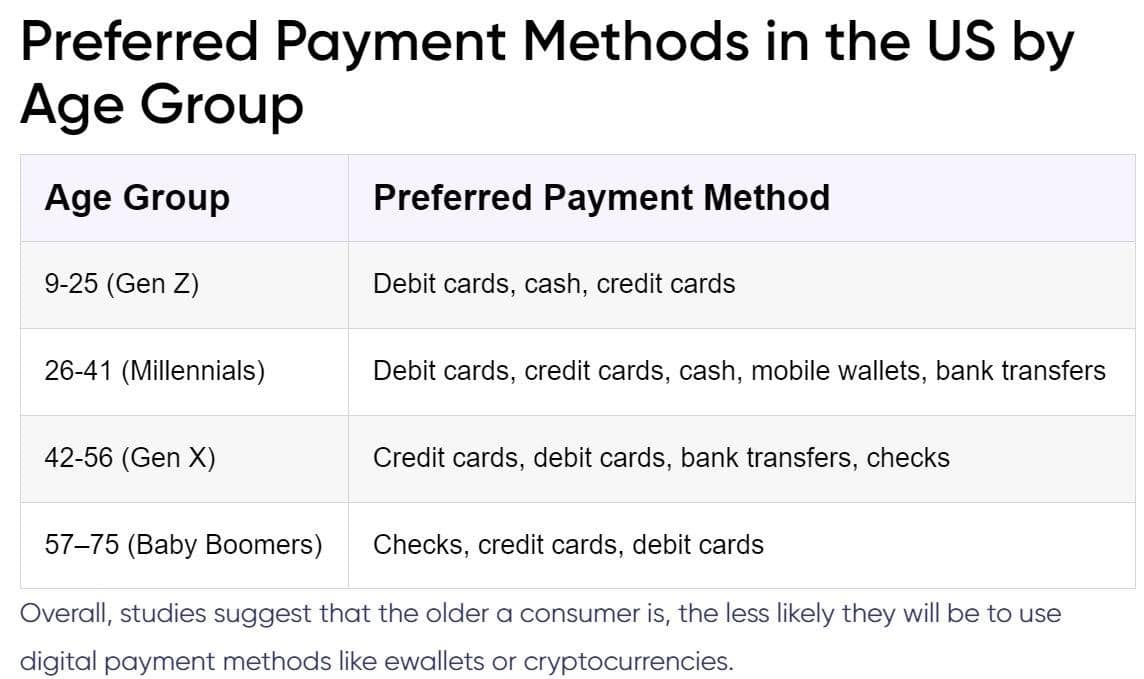

But recently, payment trends have shifted drastically from cash and checks to online transfers and card payments. A lack of preparation and anticipation on your end for these requests from your tenants can lead to potential issues, like delays or delinquencies in your rental collections.

Over 50% of Detroit renters are in the Gen Z and Millennial age bracket—the dominant payment methods for these age groups are overwhelmingly debit cards, credit cards, and bank transfers/mobile wallets.

Although some of these age groups still have cash on hand or checking accounts, the preference is still for instantaneous transaction methods over traditional checks.

If you’re scared to try this out, we recommend using rental payment apps such as PayPal and Venmo, which already enable all kinds of online and cashless payments. Other added benefits of these types of platforms include easier reconciliation and viewing of collection records.

Anticipate and Track Your Expenses

There are different kinds of costs when owning a rental property. Knowing your expenses ahead of time can help you plan properly.

- Fixed Costs: You can expect this kind of cost because they don’t change whether your occupancy rate increases or decreases (e.g. HOA and maintenance fees).

- Variable Costs: This will vary depending on your activity in your rental properties. For example, if you have a tenant you need to evict, you’ll incur additional legal fees.

Once you have an idea of the costs you can expect to incur, you can accurately predict cash flow and profit.

Reserving A Piece of Your Profit for a Rainy Day

When you turn a profit, it’s important to have some earnings set aside for emergencies.

The general rule is to keep 3-6 months’ worth of expenses on hand, so that you can cover things like taxes and property maintenance in the event of an extended vacancy.

DIY or Hire an Accountant?

So, now that you know how you can handle accounting properly, should you do it yourself, hire a CPA, or use landlord software?

Basically, the pros and cons of each option boil down to 2 things: time and money.

In terms of cost, the DIY option is free. But it takes up a lot of your time – roughly 120 to 150 hours yearly (rent collection, tracking and accounting for all income and costs, etc.). And how much do you value your time per hour?

Hiring an accountant can range from $40 to $400 an hour, but you can sit back and focus on other things, like expanding your portfolio. So it really depends, again, on how much your time is worth to you.

Rental property software like Avail and RentRedi, can be free (for a free account) or cost up to $20 a month, but you will still have to manage it yourself, which takes time – although not nearly as much as DIY accounting would.

Take your pick – what works best with your property management style?

Proper Accounting = Less Hassle, More Profit

As the saying goes, you need to spend money to make money. Managing properties will cost you money (AND time), and it’s up to you to choose how much you want to invest.

At the end of the day, you need to prioritize financial planning to avoid costly mistakes and ensure a successful business. If you think you can do it yourself, make sure you know all the numbers, at all times. But if you don’t feel confident that you can stay on top of everything, there’s no harm in asking for help from the pros.

Look no further! Contact us today and let our team handle your rental property accounting for you.

Are you looking to expand your real estate portfolio, but don’t know where to invest? We got you covered. Read our article on where to invest next.