Investing In Real Estate vs Stocks: Which is Better?

What do you do with your money? Aside from spending it on essential expenses like food and housing, do you use your spare cash to eat out at a fancy restaurant or cover the down payment for a new truck? Perhaps you use it to spoil yourself after a hard day’s work?

We deserve nice things; it’s true. But saving your money is worth more than temporary happiness, so you’ll have the funds to handle emergencies, accidents, and more. It doesn’t stop there either, as you can go the extra mile and use your money to quadruple your savings.

Investing is the surefire way to make the most out of your money, so it’s not sitting in the bank collecting dust and depreciating. However not all investments offer the promised rewards. So what’s the best way to invest it? Should you invest in real estate or stocks?

Let’s answer that age-old question below.

What is Real Estate and Stock Investing?

Investing in real estate is buying property, usually to earn a return through rental income or appreciation of the property’s value. Real estate investing can be a great way to generate passive income and build wealth over time. Still, there’s always the potential for loss if the property doesn’t appreciate or you have trouble finding tenants.

Investing in stocks is buying shares of ownership in a publicly traded company. When you invest in stocks, you become a shareholder and are entitled to a portion of the company’s profits. Like real estate, stocks can be a great way to build wealth over time. But they’re also much more volatile than real estate, which means they can go up and down in value rapidly.

Investment Returns of Real Estate vs. Stocks

The returns you can earn on your investments will depend on several factors, including the type of investment, the amount of risk you’re willing to take, and the current market conditions. But, in general, real estate tends to be a more stable investment than stocks, as property values are less affected by economic downturns than stock prices.

But that doesn’t mean that real estate consistently outperforms stocks. Stocks have outperformed real estate over long periods by a significant margin. For example, from 1928 to 2016, the US stock market posted an average annual return of 10%, while US real estate returned an average of 6%.

So while stocks may be more volatile, they also have the potential to earn you a higher return. It all boils down to how much you want to achieve from your investment and how much risk you’re willing to handle.

Investment Risks of Real Estate vs. Stocks

All investments come with some risk, and real estate and stocks are no exception.

Real estate investment risks include vacancy rates, tenant turnover, repairs and maintenance, and changes in the local market. Say, if your rental property is located somewhere experiencing a sudden decrease in population, you may have trouble finding tenants to occupy your rentals.

Stock market risks include economic recession, inflation, and interest rates. For example, if there’s a recession and companies lay off workers, their stock value will likely go down. No investment is risk-free. But some investments are riskier than others–like how stocks are compared to real estate.

Pros and Cons of Real Estate vs. Stock Investing

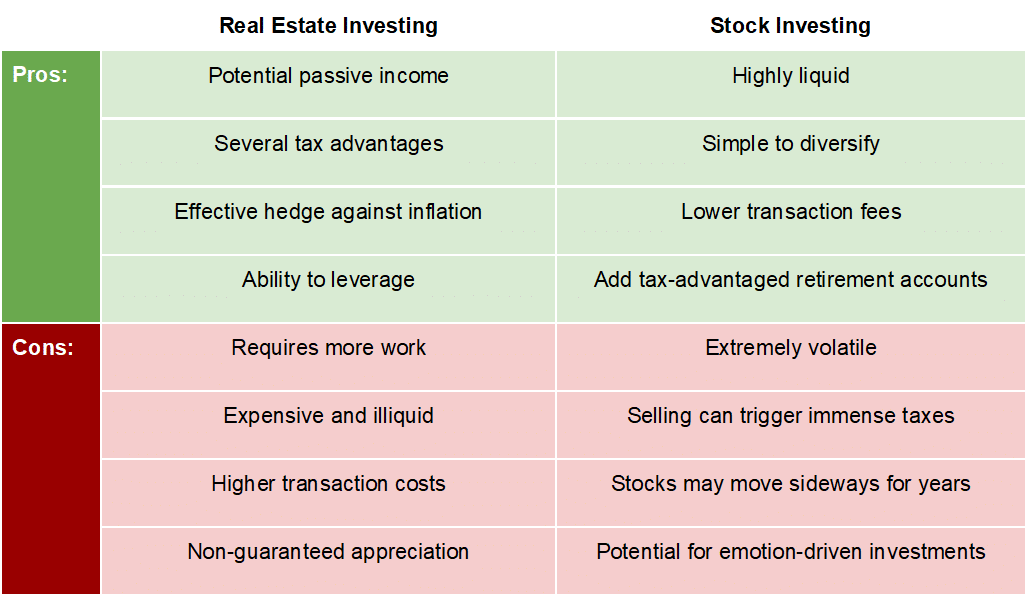

Take a look at the chart below for an overview of the pros and cons of real estate vs. stock investing:

Questions to Decide Between Real Estate vs. Stocks

You need to consider several factors before making a decision, including your financial situation, risk tolerance, goals, and investment style. To simplify things for you, here are four questions to ask yourself to determine which investment is better for you:

- How much money do you have to invest? If you’re looking to invest a large sum of money, real estate is a good option, because you’ll need a down payment to buy a property, and properties are generally more expensive than stocks.

- What are your investment goals? If you’re looking to generate income, real estate can provide you with passive income through rental payments. If you’re looking to build wealth over time, stocks may be a better choice for appreciation.

- How much risk are you willing to take? Stocks are much more volatile than real estate, which means they can go up and down in value rapidly. If you’re uncomfortable with that level of risk, real estate may be a better investment for you.

- What’s your investment style? If you’re looking for an active role, real estate allows you to be involved in the property’s management. But if you prefer a hands-off approach, stocks can be easily bought and sold without your involvement.

If you’re still unsure of whether real estate or stocks is right for you, consider speaking with a financial advisor. They can help you assess your specific situation and make an informed decision about how to best invest your money.

So, Which One’s the Winner?

Ultimately, the decision of whether to invest in real estate or stocks is a personal one that depends on your unique financial situation.

Suppose you ask me, however, my money’s on real estate. I have a growing portfolio of several rental properties scattered around the Metro Detroit area, and I’m seeing great returns so far. Not only that, but I enjoy the process of finding and managing tenants. It’s a lot of work, but I get help from my property management company for dealing with complexities anyway.

Do you want to know more about investing in Metro Detroit real estate? Get in touch with my team today. We’ve been operating in the area for over two decades now, and have everything you need to start generating wealth via rental property investing.