How to Use Retirement Money for Real Estate Investing

If you’re like most people, you might think of investing your retirement money in stocks, mutual funds, and exchange-traded funds. You probably didn’t consider real estate to be an option—even though the Internal Revenue Service (IRS) freely allows retirement accounts to invest in properties.

Why should you consider real estate, you may ask?

Well, one of the most significant advantages of real estate investing with retirement funds is that your gains are tax-deferred until you make a distribution. For Roth accounts (where the retirement plan uses after-tax dollars) your gains are even tax free!

Here’s an example of what we mean: If you acquired a property with your retirement funds for $100k and later sold it for $300k, the $200k difference would be tax-deferred. It’s not subject to federal or state income tax, unlike if you buy the property using personal, non-retirement funds.

Get a higher return on investment (ROI) and pocket more cash for your next vacation—simply by using your retirement money to invest in real estate. It’s an excellent investment strategy that few people dabble in.

So, if you’re looking to try a more creative investment method, read on to learn the basic rules of individual retirement accounts (IRAs) on real estate investing.

Basic Rules for Real Estate Investing with Retirement Funds

The IRA has many rules on real estate investing with retirement money, but here are the important ones you should know:

You can’t live in the property or use it for personal benefit. You can’t maintain or repair the property yourself—you have to hire third-party services.

You can’t get tax breaks or claim depreciation if you’re operating at a loss.

Instead, the main goal of real estate investing with retirement funds is to reap tax benefits. Here are the advantages if you follow their rules:

You’ll have tax-deferred income until you make withdrawals. You’ll enjoy tax-free investments and withdrawals if you invest with Roth IRA.

You’ll need to be at least 59½ years old to withdraw your funds (or there’ll be a penalty), but you can move the money from one project to another. Buying, selling, and flipping properties while the funds are in their tax-deferral state is still permitted.

Now that we’ve covered their basic rules, let’s discuss the two ways you can include real estate in your retirement investment portfolio.

Overview of the Qualified Retirement Plans

The IRS allows you to invest in real estate through two qualified retirement plans:

Self-Directed IRA: A self-directed individual retirement account (SDIRA) is a type of IRA administered by a custodian/trustee and managed by the account holder. It can hold alternative investments usually prohibited with traditional IRAs, allowing investors to diversify in a tax-advantaged account.

Self-Directed Solo 401k: A self-directed solo 401k plan is a retirement plan for a self-employed sole proprietor, corporation, or limited liability company (LLC). It’s an IRS-approved, qualified 401k plan that allows the participant to contribute both as an employee and employer—resulting in high contribution limits.

Both of these plans allow you to purchase real estate with retirement money. Just remember to follow IRA guidelines to remain eligible for the tax benefits.

Steps to Real Estate Investing with Retirement Funds

Here are three main steps to purchase real estate with your retirement money.

Before jumping into real estate investment, the most important decision you have to make is choosing the retirement plan you’ll use. I advise that you take your time evaluating the two options according to your investment goals.

1. Choose a Qualified Retirement Plan.

The first step is to pick and open a self-directed retirement plan.

Establishing a self-directed IRA is quick and relatively inexpensive, while a self-directed solo 401k retirement plan only allows full-time real estate investors (owner-only businesses or self-employed individuals) to invest using retirement funds.

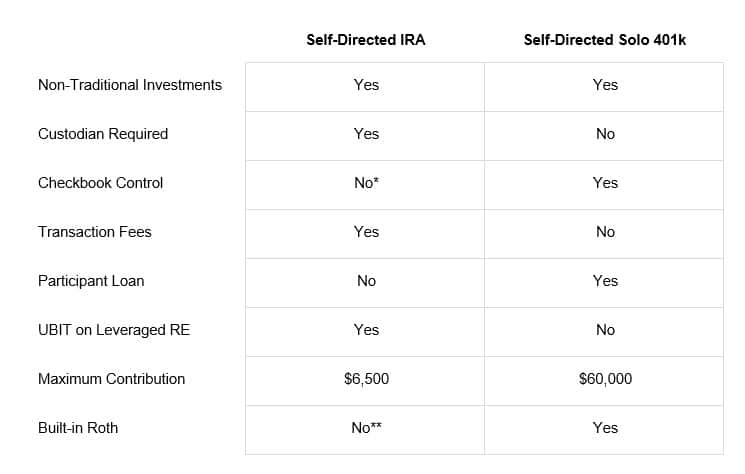

Here are some other details to consider:

*Available with Checkbook IRA, single-member special purpose LLC is required

**Requires separate self-directed Roth IRA account

2. Fund with Rollovers and Contributions.

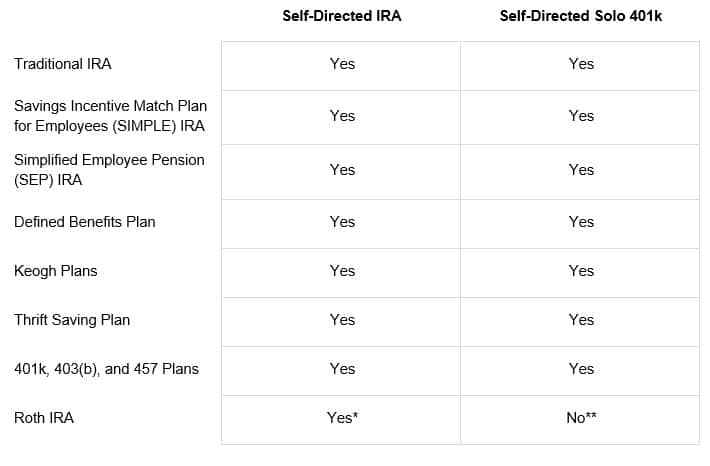

Once the plan is active, fund it with qualified rollovers:

*Convert a Roth IRA to a self-directed Roth IRA

**Convert a Roth 401k plan to a Roth Solo 401k plan

3. Purchase an Investment Property.

At this point, you can look for a good real estate opportunity to invest in. You can consider residential properties, commercial units, and even mortgage notes or tax liens/deeds. The last option offers a more passive income generation than actual properties.

Let’s say you choose to invest in a single-family home. Once you’ve identified your property, use the funds you have from whichever retirement plan you chose to make the purchase. If you need more funds, the IRS allows you to finance the purchase with a non-recourse loan (not personal funds).

In terms of property title, here is where the two plans differ:

Self-directed IRA: Your custodian holds the property title.

Self-directed Solo 401k: Your solo 401k trust holds the property title. You’ll sign on its behalf as the trustee of the plan.

Make sure you title the property accordingly.

Lastly, remember that you need to use the retirement account for all transitions, including any expenses (e.g., third-party property management service) and income generated. This rental income then grows tax-deferred within your retirement plan, where you can eventually make qualified withdrawals after paying the due taxes.

Conclusion

While investing can be a complicated topic, it doesn’t have to be. You now know how to invest in real estate with your retirement funds to enjoy tax-deferred or tax-free income and gains. If you need more help with all the complicated IRS rules, I recommend that you consult with your go-to tax professional for further guidance.

And if you need more advice on real estate investing (especially in the Metro Detroit area), our team is more than willing to help you. Get in touch with us today!

Any thoughts on investing retirement funds in real estate? We’d love to hear your thoughts below.

Image courtesy