How to Buy an Abandoned Property (And What to Do Next)

In 2020, it was estimated that 11% of all housing units in the United States are abandoned—that’s over 16 million properties across the country that you could purchase, flip, and rent out. Plus, just because a property is unoccupied doesn’t mean it’s uninhabitable, as vacancy could be influenced by location or demand and supply without being run down at all.

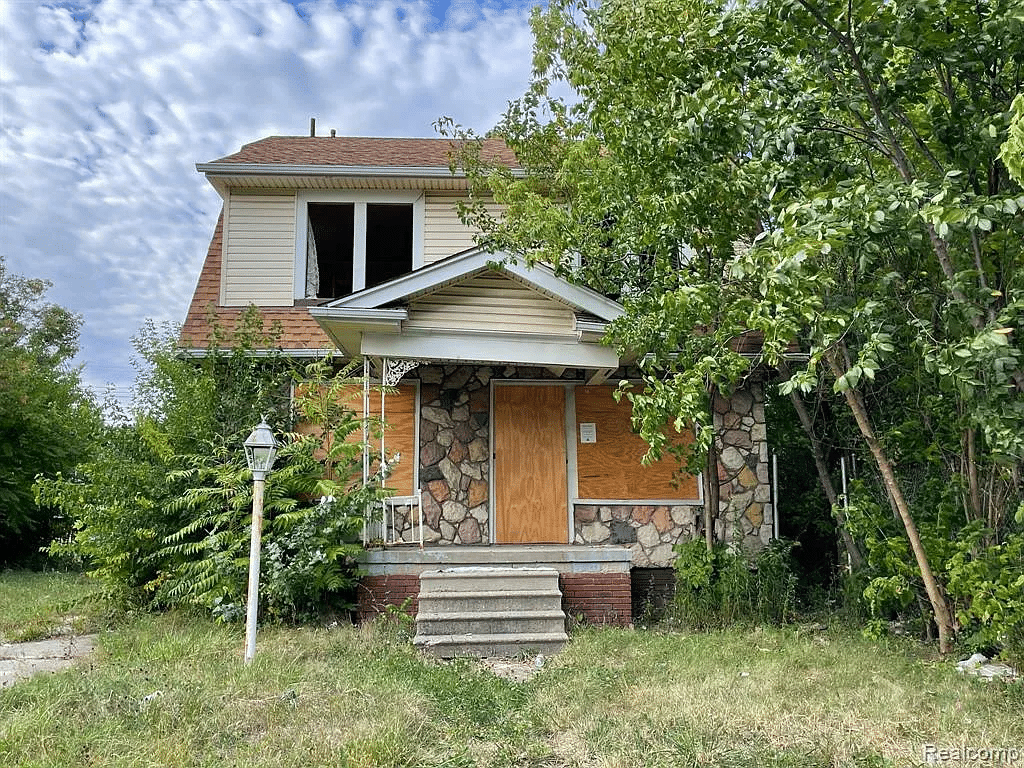

For example, the City of Detroit had a population close to two million back in 1950. But due to political issues, residents fled the city, and less than half of the original population is retained today. The result? There is an oversupply of vacant properties in the Detroit housing market—all ripe for you to swoop up. Many are in good shape; some need renovations. Either way, they’re affordable properties rising in value.

The question is, how can you spot a good deal on an abandoned property?

Criteria When Scouting Abandoned Properties

Before buying any abandoned property, make an ocular visit to the area and survey the general surroundings, much like you would with any property hunt. As you peruse, ask yourself:

- Attractiveness: Is the empty property located near essential and attractive amenities such as public services, quality schools, and parks? Evaluating property attractiveness determines your tenant pool (e.g., families with kids vs. young professionals looking for their first rental).

- Neighborhood Livability: Is the neighborhood safe with reasonable crime rates? Are there a lot of employment opportunities? What lifestyle will it provide potential tenants? Put yourself in the shoes of future residents and see how livable the neighborhood is.

- General Condition: How thorough of a renovation is required to bring the property up to code? Work with a licensed inspector to stay within budget. Plus, depending on the financing you’ll get, you may have to renovate before closing, which can affect your finances.

Visit properties yourself and don’t trust photos online—empty properties may be represented differently online or in advertisements. Do your due diligence, especially if you’re a beginner or out-of-state investor.

How to Find Abandoned Properties

Here are a few ways you can find abandoned properties (aside from literally just driving around a neighborhood to spot tell-tale signs of a property without anybody living in it):

- You can consult a local real estate agent, as they usually know about abandoned properties before anyone else. Realtors can help you stay ahead of the game and purchase it first.

- Browse through online listings, too, even if it might take a little more time. When looking at online listings, filter them down to foreclosed and vacant to narrow down the list.

- Consider repossessed properties, which are properties seized by banks or governments when the homeowner fails to pay any loan obligation. You can find lists of repossessed properties on a bank’s website, the US Treasury website, or your local clerk’s office.

- Attend property auctions to find abandoned properties. Host organizations (e.g., banks or government agencies) often have properties that they’d love to liquidate as soon as possible—they’re not real estate investors, after all.

Find the Owner & Speak to the Right People

Once you find the perfect property to purchase, identify whether it’s an individual, the government, or a bank that you need to deal with to move forward. You’ll need more details, such as the condition of the title and/or deed and if there are any roadblocks such as liens or delinquencies in relation to the property.

Depending on the property type, connect with the following professionals:

- If you found the property during an ocular: Reach out to the local Homeowners Association (HOA) or talk to the local mail carrier

- If the property is seized: Identify ownership and contact details via public records or call up your county’s office to ask for more details

- If the property is foreclosed: Contact the bank involved to proceed

For example, in the City of Detroit, you can find property owners via the Detroit City Assessor’s website. You can search the address or parcel ID number and see if the property has any tax liens against it in the Tax Lien Records. There are also many local agents that can help with finding owners.

Speak with the right people, so your investment pushes through and does not fall into the wrong hands. Some individuals and companies may claim to own or control the abandoned property, but your due diligence will mitigate the risks of fraud.

Review Your Financing Options

Abandoned properties tend to fall below the median price and can be cheaper to buy. Still, you may need to finance the investment instead of emptying your pockets. If the purchase doesn’t qualify for a traditional mortgage, you can check if some government agencies offer financing programs.

Consider your timeline, too, because if you get your property through an auction, you’ll need financing immediately. If you purchase the property directly from the owner, you do have a little time to settle your finances—line your ducks in order before jumping into the pond.

Besides purchasing the property, also consider the amount of money it will take to renovate to upgrade the property. Ensure that everything is planned and within budget so that everything will move smoothly.

Evaluate the Price

Before submitting a bid or offer, evaluate the overall investment price. Here are some questions to ask yourself to ensure that you’re pouring your money into a good investment:

- How major of a renovation is required to bring the property up to code?

- Does the ARV (after-repair value) meet or surpass market values for long-term equity gains?

- Will the property be attractive enough to get a consistent flow of tenants?

- How much rent can you charge (i.e., cash flow), and is it enough to cover your initial investment?

Crunch the math and do your research to know if the abandoned property is worth the investment, its potential as a rental property, and the returns you’ll generate both in the short- and long term.

So, What’s Next?

Once you’ve completed the purchase, get your team to work on the rehabilitation as quickly as possible. Prioritize all the things that make a property attractive to the local tenant pool, so your renovations are not in vain. After that, write a detailed listing, take good photos to showcase its beauty, list it on sites like the MLS or Zillow, and wait for the applications to come flowing in.

If you’ve done your job well, you’ll see an influx of tenants clamoring over your rental property—so much so, that you might eventually realize that you need third-party help to manage your tenants and property. Hiring a property management company means you’ll have professionals handling the day-to-day tasks of your rental business, so you’ll have more time to (you know it) work on another investment project.

Abandoned Properties and Their Endless Opportunities

We hope this guide inspires and informs you about investing in abandoned properties, turning them into cash-generating, equity-building investments for your growing portfolio. Working with abandoned properties can be lucrative—if you know how to navigate the challenges and risks.

And if you’re still not confident… Well, our team can help.

We are a team of professional property managers with over two decades of experience in our home area, Metro Detroit. It doesn’t matter if you’re a beginner or an out-of-state investor—we can give you a slice of the rewarding Detroit market you never thought was possible. Get in touch!