Consumer Housing Trends Report

As the real estate market continues to evolve, it’s vital for real estate investors to remain updated on the ever-changing renters’ preferences and trends to ensure maximum profitability of their properties. The 2022 Consumer Housing Trends Report, brought to us by Zillow, sheds light on the ever-changing landscape of the rental market.

In this article, we’ll dive deep into the key insights from the report, focusing on the renter’s preferences, rental practices, and the use of digital tools in the rental markets.

Rental Market Trends

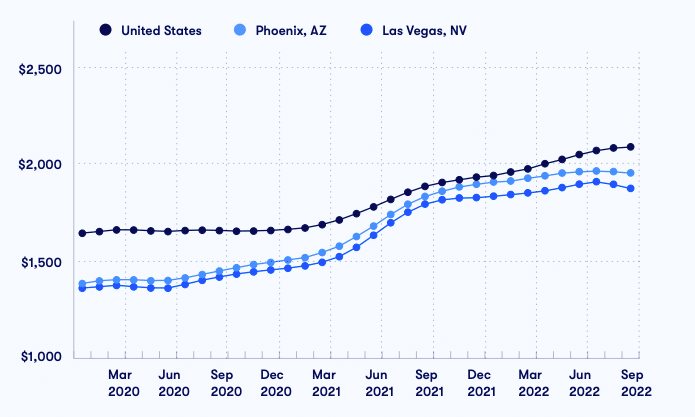

The rental market witnessed significant fluctuations in the wake of the 2020 pandemic, with a sharp decline in occupied housing units. While the situation began to improve in 2021, the economy remained sluggish, and inflation in consumer goods prices further strained renter budgets.

As we entered 2022, the rental landscape continued to be marked by rent increases, leaving an estimated 11 million households spending more than half of their income on rent—way over the recommended 30%.

With the surge in rent prices, the report suggests that it could lead to a drop in housing prices. The potential drop could open doors for some renters to leave rental units and explore homeowners—a housing market trend that’s bad news for landlords. More than that, there’s also a boost in the construction of multifamily units, which could result in increased competition in the rental market.

Although late 2022 saw a decreasing rental price trend nationwide, it’s still high compared to pre-pandemic levels. Because of that, more renters have moved to downsized homes or living with roommates or family—which could mean ease in rental demand.

Another thing that most renters struggle with is the requirement of a lump-sum security deposit and diminishing concessions, resulting in the nationwide cooling of rent prices.

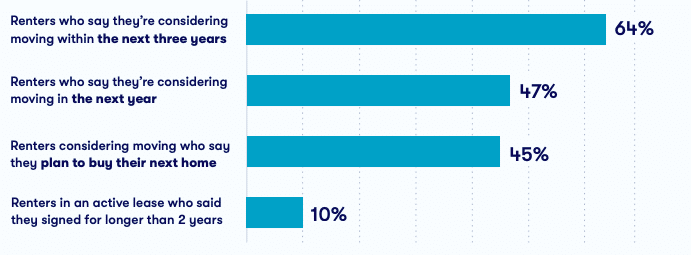

The rental vacancy rates also hit their lowest in late-2022, which could further decrease considering that a significant percentage of renters are considering moving within the next three years.

Renter Preferences

More renters in 2022 (80% of renters) said affordability is the most critical factor when choosing a property. This is followed closely by the desired number of bedrooms and bathrooms, indicating that space is still a significant consideration.

While shared amenities like gyms and gardens are appealing, they do not hold as much sway as affordability. Investors might find that focusing on cost-effective options rather than extravagant amenities could attract more tenants.

Security Deposits

Going back to security deposits, the report highlighted that a staggering 85% of renters had to pay a security deposit ranging from $500 to $999, regardless of the property type they rented. The wide gap in the security deposit range reveals that racial and age disparities exist.

For example, Latinx and Asian American/Pacific Islanders (considered renters of color) are more likely to pay higher deposits than white renters. Similarly, the oldest generations of renters tend to avoid paying a deposit altogether. And for those who rent single-family homes, they are more inclined to skip the deposit, but when they do pay, it’s usually a higher amount, typically falling between $1,000 to $1,499.

These discrepancies in deposit payments highlight the need for real estate investors to implement fair and equitable rental practices that promote equal access to housing opportunities.

Pet Owners

During the pandemic, we have seen a surge in pet adoptions since people are mostly working from home and want companionship and comfort that only animals can offer. Part of that surge is renters. Since 2018, the number of renter households with dogs increased to over a third, while those with cats rose to almost 30%.

By 2022, 59% of renters reported having at least one pet, up from 46% in 2018. And there’s no stopping this surge as the bond between renters and their furry friends continues to grow stronger.

Retention of Good Renters

As a landlord, your ultimate goal amidst rent increases in the market is to ensure a stable cash flow by increasing your qualified tenant retention. Here are three things you can do to remain profitable:

- As more renters still regard affordability as the most crucial thing, offering concessions like a free month or two of rent, competitive pricing, or free parking can attract and retain good renters.

- Reexamine your security deposit policies to reduce the upfront financial burden for tenants.

- Consider allowing pets in your rental properties to attract pet owners, who make up nearly 60% of renters.

Although the pandemic is technically over, if rent remains such a significant chunk of renters’ budgets, it’s in your best interest to focus your property messaging on value rather than amenities. Instead, consider positioning amenities as value-added features to your property.

Digital Transition of Renters

Through the help of the Internet, renters increasingly rely on mobile devices for rental searches, online applications, and lease signings. In 2022, over a third of recent renters reported signing their lease online, a 15 percentage points higher since 2018. Moreover, over two-thirds of renters say they prefer paying online payments for their rental fees.

To cater to the growing demand for remote services, offering virtual tours and remote viewing options can attract tech-savvy renters who value convenience and safety. You can also incorporate digital conveniences like online lease signing and rent payment options that can improve tenant satisfaction, streamline rental processes, and ultimately reduce turnover rates.

Overall, renters, especially the younger generation, expect cohesive digital experiences. So, as a landlord, it’s time to improve your digital footprint while ensuring that your site and other digital assets are compatible with smaller screens.

Understanding The Typical American Renter

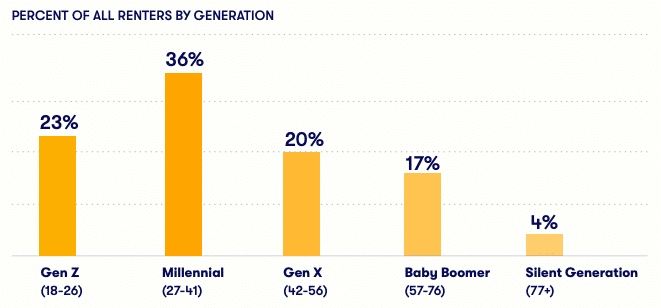

The typical renter in 2022 is around 39 years old, with younger individuals around 31 years old constituting recent movers.

Millennials, now the largest living generation, also make up the most significant chunk of renters. That’s because, after the Great Recession, homeownership became even more challenging for millennials than the older generations. Factors like stagnant wage growth, pesky student loan debt, and a tight housing market forced many millennials to continue living with their parents while saving for the down payment.

Renters are also more likely to live in the South or the West, with nearly half wanting to live in the suburbs.

As for the property types, apartment buildings remain the most popular housing option among renters, and the typical preferred rental home consists of two bedrooms and one and a half bathrooms.

Conclusion

As a real estate investor, staying informed about the latest rental market trends and renters’ preferences is pivotal to making well-informed decisions and optimizing property profitability. The insight gleaned from the 2022 Consumer Housing Trends Report offers invaluable guidance to navigate this ever-changing landscape successfully.

By prioritizing affordability, embracing digital tools, and understanding the needs of renters, investors can attract and retain quality tenants while also adapting to the evolving demands of the rental market. Armed with this knowledge, you can forge ahead with confidence and ensure your real estate investments thrive in the competitive and dynamic world of rental housing.