2024 Metro Detroit Real Estate Forecast for Rental Property Investors

Is 2024 a good time to invest in Metro Detroit rental properties?

Well, to help you decide, we’ve collected evidence-based trends on the real estate market for you to review. Although this article isn’t a comprehensive source for you to make final investment decisions in the tri-county area, the information will give you a good grasp of the real estate situation in Detroit-Warren-Dearborn today.

If you’re looking to invest in Metro Detroit rental properties, it’s important to take the time to read the statistics and analysis below. That way, you can use positive factors to identify hot opportunities in the area, and you can use negative factors to navigate risks.

1. Rising Home Prices, Rising Appreciation & Rental Demand

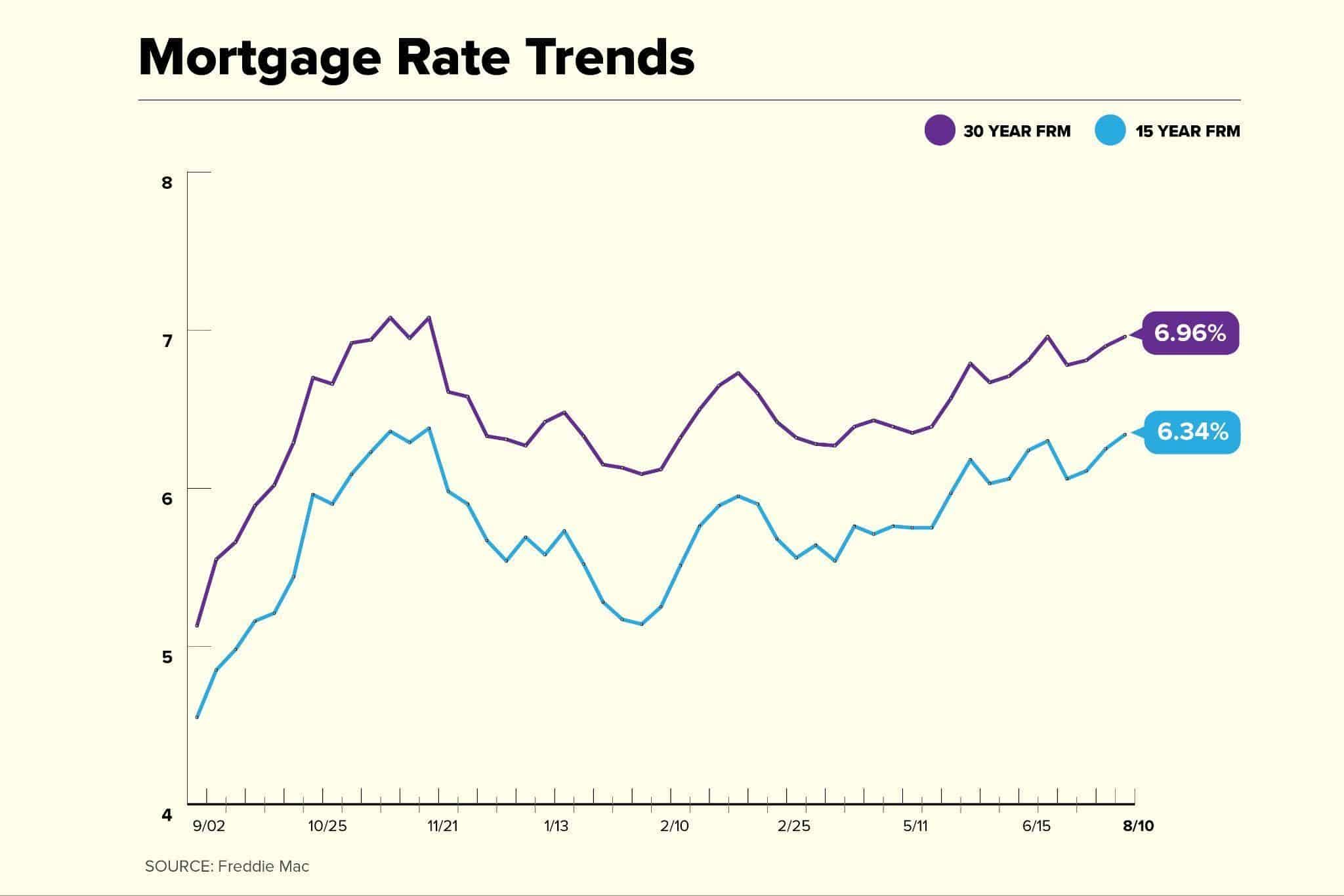

As of July 2023, the average Metro Detroit home value is $260,400, an increase of 9.28% over 2022 prices. The growth has slowed considerably compared to just last year, thanks to the effects of rising mortgage rates.

Here are more home value statistics in the smaller areas within the past year:

- City of Detroit home values grew 2.62%, reaching $86,000.

- Wayne County home values fell by 11.6%, reaching $145,000.

- Oakland County home values grew 16.16%, reaching $399,000.

- Warren home values plateaued, reaching $169,900.

Thanks to the effects of ballooning mortgage rates, the growth of the real estate market slowed considerably for Michigan. But it’s not all bad news over the horizon. There’s a silver lining for rental investors. The lack of available housing inventory despite increased demand means prices will cease to fall—translating to equity gains on top of your monthly cash flow.

However, given the price increase, you might also run into overpriced homes—homes overvalued by as much as 20%. So, you’ll have to be careful in ensuring that you don’t pay too much when purchasing a Metro Detroit property, or it’ll be a long and challenging road trying to get positive returns.

2. Slow Down of New Homes, Surging Housing Prices

Unfortunately, as Metro Detroit housing prices skyrocket, new construction projects are experiencing a plateau in development and expansion. Builders are creating less than 5,000 new houses annually, the limited inventory is frustrating potential property buyers, and prices are increasing in response.

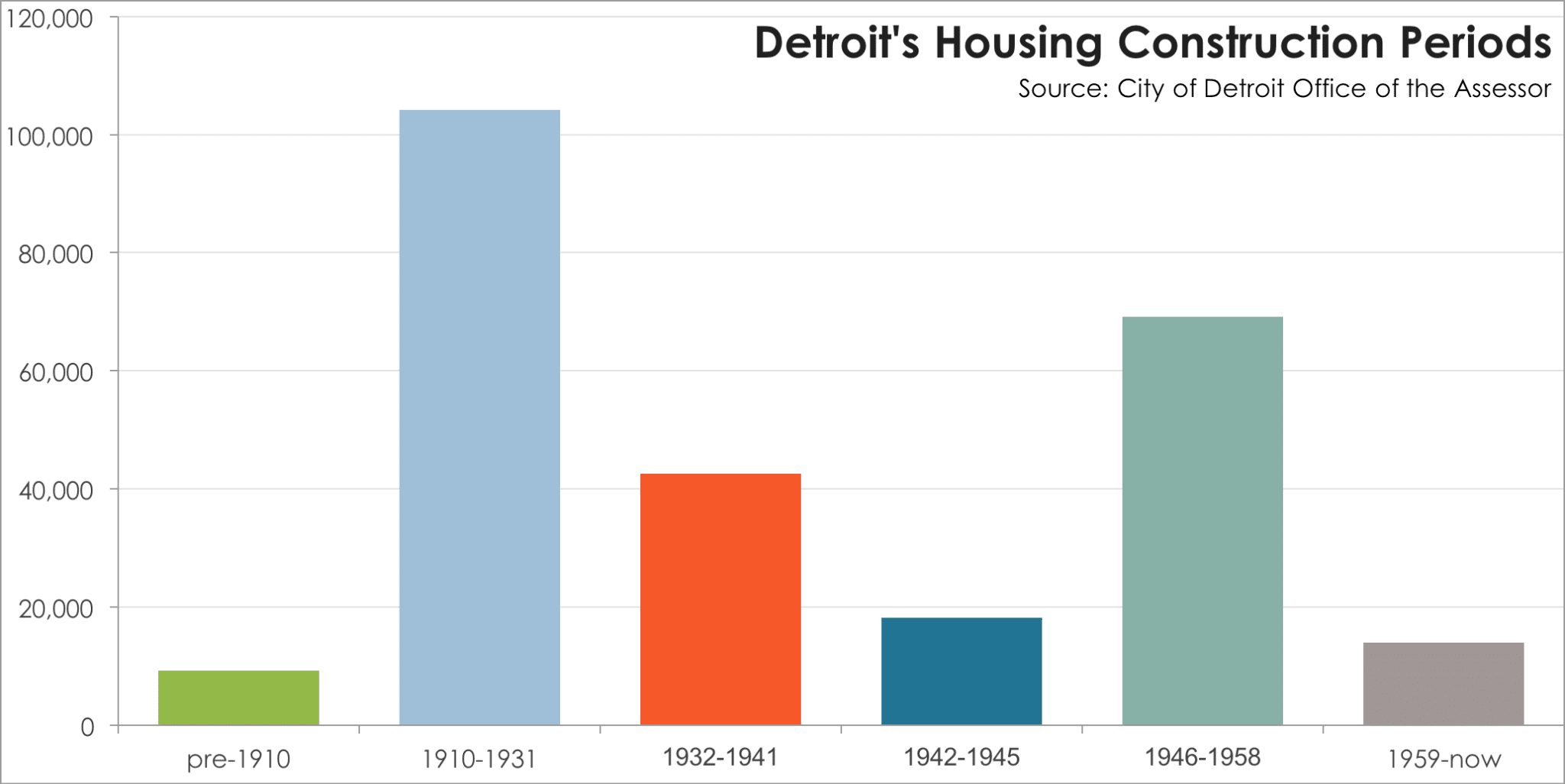

This is a continuation of the same construction problem that Metro Detroit has seen for a while. That’s why we see more old homes (above 50 years old) in the area than newly built ones:

The good news? As costs for materials and labor are increasing, there are entrepreneurs in Metro Detroit who are creating nontraditional building methods to have more affordable housing options. This includes 3D-printed homes, tiny homes, and houses made from shipping containers—all increasing in popularity as they showcase new possibilities for the future of property construction in the area.

In other words, you might see fewer and older homes for sale in Metro Detroit. However, there are also many hidden gems and fix-and-flip opportunities that’ll potentially earn you more than you initially planned.

3. Increasing Interest Rates, Increasing Mortgage Payments

High mortgage rates are causing grief over any new property acquisitions. But potential landlords aren’t the only ones meeting some financial woes. In fact, many tenants will also deal with a greater financial squeeze from their car loans, credit cards, and more. This is definitely something to keep an eye on if you’re looking to buy right now.

Fortunately, rising mortgage rates haven’t dampened buyer demand in Metro Detroit. Prices are, for the most part, keeping steady, and the inventory of available homes is dwindling. But the primary concern is really to get your offer accepted. We see this difficulty challenging the home buyers we’re currently handling as well.

4. Growing Rent Amounts, Growing Cash Flow Potential

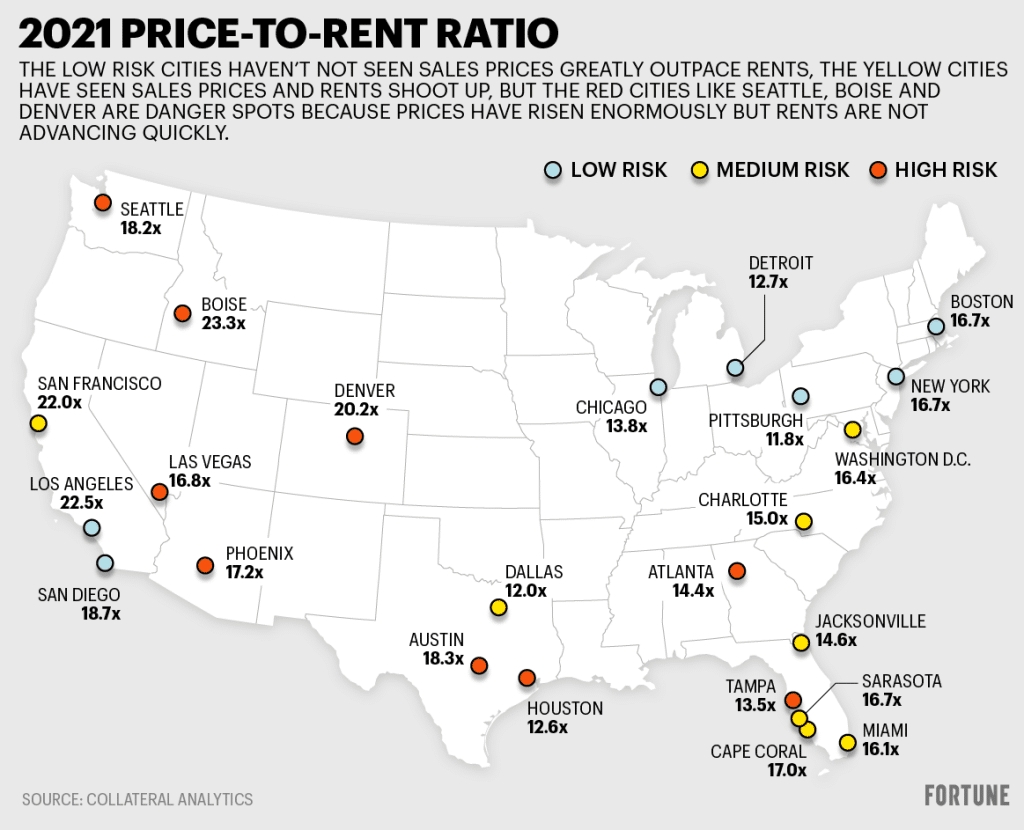

In terms of rent, Metro Detroit remains healthy and, in fact, increased by 37.51% over the past 8 years. Moreover, the City of Detroit experienced the highest rent increase compared to other markets back in 2017, and the overall price-to-rent ratio (lower is better) in Metro Detroit remains relatively healthy:

While this means that you can potentially charge higher or increase the current rent you ask from tenants, it also threatens the renters’ financial capability to be able to afford your [property in the first place. Relentless rent hikes are taking a significant portion of tenant paychecks, so you have to ensure that they still earn at least 3x of the rent amount you charge.

The Unique Investment Opportunities in Metro Detroit

Rental investment opportunities continue to fill the real estate market in Metro Detroit. As long as you take the time to conduct thorough research and get insider knowledge with expert property managers and agents, you’ll find lucrative deals in Metro Detroit that’ll garner great returns now and in the future.

Get in touch with our team to find out exactly how to invest in Metro Detroit and avoid the pitfalls! We’ve been operating in the area for more than two decades and have everything you need to succeed.