2023 Metro Detroit Real Estate Forecast for Rental Property Investors

Is 2023 a good time to invest in Metro Detroit rental properties?

To help you evaluate, we’ve collected evidence-based trends on the real estate market for you to review.

Although this article isn’t a comprehensive source for you to make final investment decisions, the information will give you a good grasp of the real estate situation in Detroit-Warren-Dearborn today. Use positive factors to identify hot opportunities in the area, and negative factors to navigate risks.

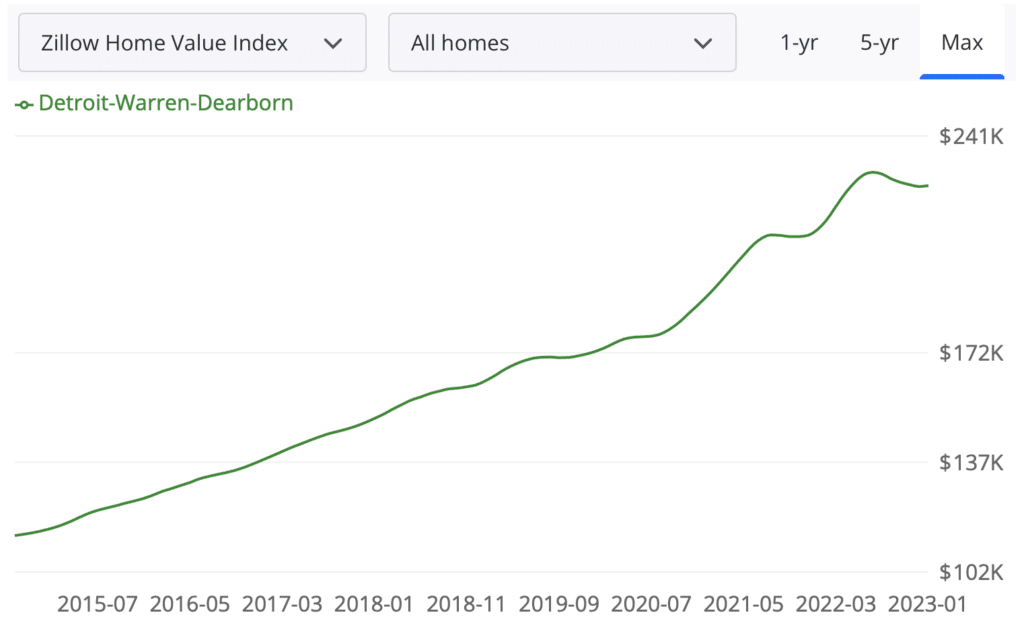

1. Rising Property Prices & Rising Appreciation

The average Metro Detroit property value is $226,101—an increase of 6.6% in the past 12 months. There’s no stopping Metro Detroit because its most-recent one-year forecast showed a growth increase of 1.4%, a trend that’s mainly driven by favorable appreciation rates and the area’s affordability.

Here are more property value statistics in the smaller areas from 2022:

- City of Detroit property values grew 23.7%.

- Wayne County property values grew 13.9%.

- Oakland County property values grew 11.4%.

- Warren County property values grew 13.2% (not a county).

- Dearborn County property values grew 13.4% (not a county).

Thankfully, we expect these figures to continue to increase this year, which means rental investors will have equity gains on top of monthly cash flow in 2023.

However, given the price increase, you should watch out for overpriced properties in 2023 because, in 2022, overpricing was seen by more than 20%. So, ensure that you don’t pay too much when purchasing a Metro Detroit property, or it’ll be a long and challenging road trying to get positive returns.

Here are some of the best Detroit neighborhoods you can consider investing in based on their excellent appreciation rates (among many other investment criteria):

- Warren

- Dearborn Heights

- Redford

- Clair Shores

- Hazel Park

- Lincoln Park

These are only a few of the hotspots you can find in Metro Detroit. We have an ongoing Deep Dive series that unpacks the best (and worst) areas in the metropolitan for you to consider, so head over there for more investment information.

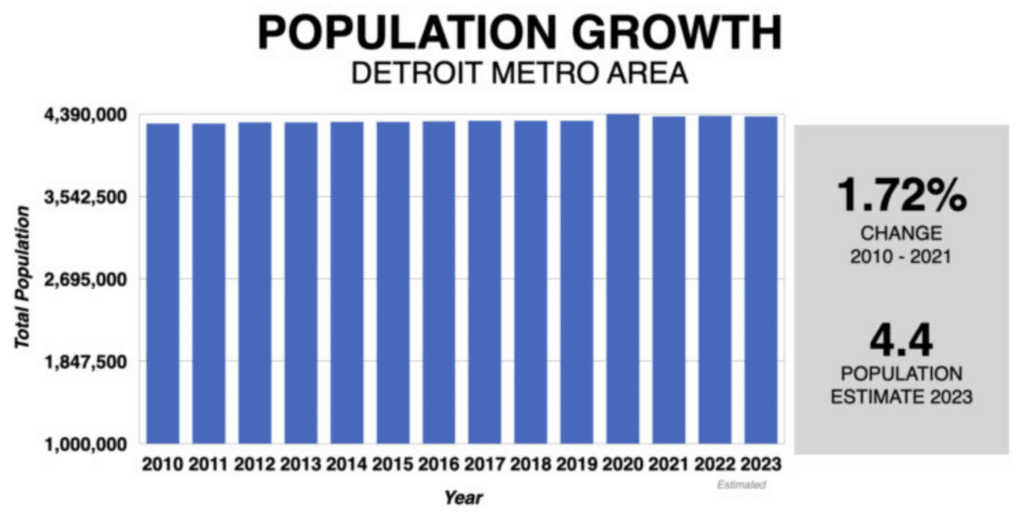

2. Growing Population and More Job Opportunities

Metro Detroit is home to 4.3 million people, and the city has been experiencing a slower population growth rate than the national average. However, there’s been an influx of young professionals and immigrants over the past few years, and the still-growing population equates to more potential tenants and demand for rental properties.

Take advantage of the incoming people, especially young professionals, for an idea of your potential tenant classes and whether they fit your standards. The fast-paced influx of young professionals brings new businesses to Metro Detroit’s large corporation scene. More businesses mean more jobs which also means more demand for residential properties.

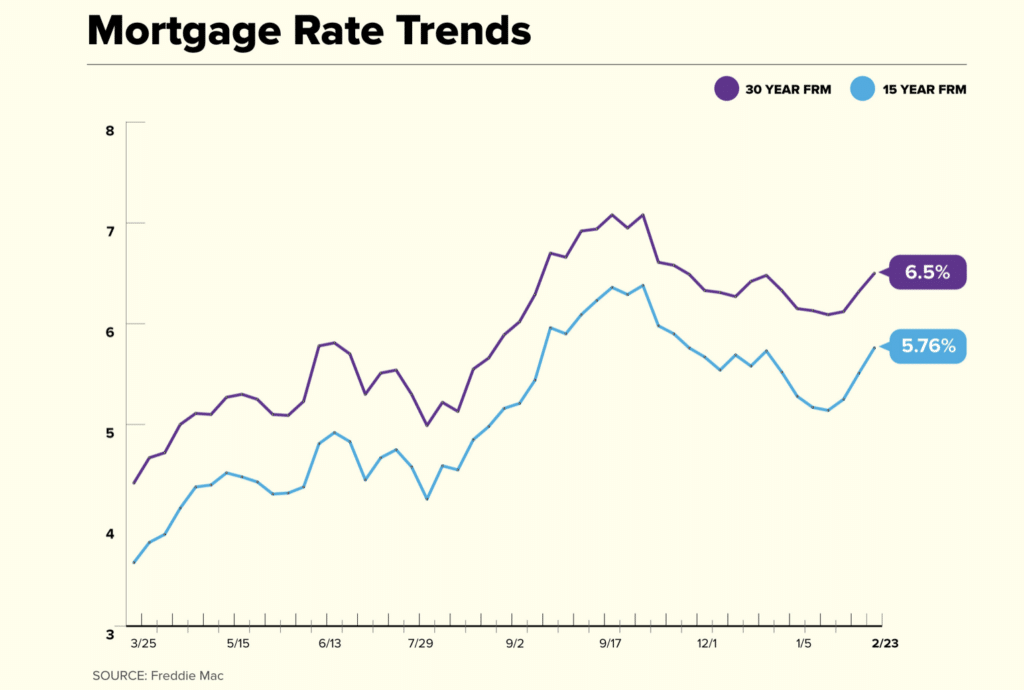

3. Increasing Interest Rates, Increasing Mortgage Payments

As inflation skyrockets, not only will you experience higher mortgage rates as a property investor, but many tenants will also deal with a greater financial squeeze from their car loans, credit cards, and more. This is definitely something to keep an eye on if you’re looking to buy right now.

Fortunately, rising mortgage rates haven’t dampened buyer demand in Metro Detroit. Prices are soaring, and the inventory of available properties is dwindling, but the primary concern is getting your offer accepted—this is the challenge we see for our property buyers.

4. Growing Rent Amounts, Steady Cash Flow Potential

Regarding rent, Metro Detroit rent amounts increased 37.51% over the past eight years, and trends show an average increase of 4.61% per year. For landlords, this means more monthly cash flow this year.

The overall price-to-rent ratio in Metro Detroit remains relatively healthy for 2023. Many properties in the city are priced under $100,000—much more affordable than properties found at median prices in other cities across the US. In addition, many properties in the area provide solid cash flow for investors (if done correctly!) because they comply with the 1% Rule.

The area’s growth means you can potentially charge more or increase the current rent you ask from tenants. However, relentless rent hikes are taking a significant portion of tenant paychecks, so ensure tenants earn at least three times the amount you charge.

The Unique Investment Opportunities in Metro Detroit

Rental investment opportunities continue to fill the real estate market in Metro Detroit. As long as you take the time to conduct thorough research and get insider knowledge with expert property managers and agents, you’ll find lucrative deals in Metro Detroit that’ll garner great returns now and in the future.

Get in touch with our team of property managers to know exactly how to invest in Metro Detroit. We’ve been operating in the area for over two decades and have everything you need to succeed.

With our team by your side, 2023 is an excellent time to start investing in Metro Detroit. We guarantee it!