Introduction to Real Estate Investment Analysis

Here’s the story of Marco (maybe it sounds familiar…?)

Marco really wants to get into real estate investment. He has no idea how to do it, but he wants to become rich like Donald Bren—the wealthiest real estate mogul in the world, with an estimated net worth of $15.5 billion and hundreds of properties under his belt.

But what Marco doesn’t know is: How did Donald Bren know what to invest in, and what would give him great returns?

If you’re in the same situation as Marco, you’re reading the right article. We’ll introduce you to the basics of real estate investment analysis and give tips on how to get started as a beginner investor!

Choosing Your Property Type

The first thing you need to know is that there are different property types to invest in:

a. Residential – Single-family homes and apartments

b. Commercial – Offices and malls

c. Agricultural – Farms, and ranches

d. Industrial – Warehouses and factories

e. Mixed-Use – Combination of multiple types

f. Special Purpose – Schools and cemeteries

We suggest that you start with renting out a residential property to learn and get the hang of things first, as it’s an easier and more common real estate investment.

Look for a Property You’re Interested In

Browse house listings on websites such as Zillow and Trulia to find potential investments, and if you want more information on Metro Detroit cities and neighborhoods in particular, you can check out this Deep Dive series for more options.

Analyze the Key Elements

The smallest changes in either income or expenses can significantly affect your bottom line. So, even if you don’t want to, it’s time to do the math.

Money is at the root of all investments. Make sure you determine the financial viability and stability of a real estate investment before writing those checks!

The key elements in doing so are the following:

a. Net Operating Income (NOI)

b. Cash Flow

c. Capitalization Rate

d. Cash-on-Cash Return (COC)

Each of these elements indicates the potential performance and, ultimately, the return on investment (ROI) of a rental property, allowing you to make well-informed investment decisions.

You’ll need the property, purchasing, and financing details you gathered earlier to calculate potential rental performance. Let’s use a house along W Garfield Avenue in Hazel Park—a small suburb in the City of Detroit—as an example:

a. Units/size: Two bedrooms, one bathroom, large backyard

b. Price: $119,000 (less than the neighborhood average of $122k)

c. Gross income: $14,400 annually

d. Vacancy rate: 10% (on average)

e. Taxes: $2,076 annually

f. Insurance: $504 annually

g. Maintenance: $1,190 (estimated 1% of total purchase price)

f. Net Operating Income (NOI): $8,940

Using these details, we can estimate the budget needed to invest:

Cost assumptions:

a.Down payment: $23,800 (estimated 20%)

b. Closing costs: $4,760 (estimated 3-5%)

c. Cost of repairs: $0 (assuming the home doesn’t need repairs)

d. Cash-out of pocket (COC) = $28,560

Financing assumptions:

a.Down payment: $23,800

b. Financing: $95,000

c. Interest rate: 3.02%

d. Mortgage length: 30 years

e. Mortgage payment = $546/month

The estimated cash outlay is $28k, followed by a monthly mortgage payment of $546. Will this be a good investment? How much money will the property make you? The key calculations below will show us the answer.

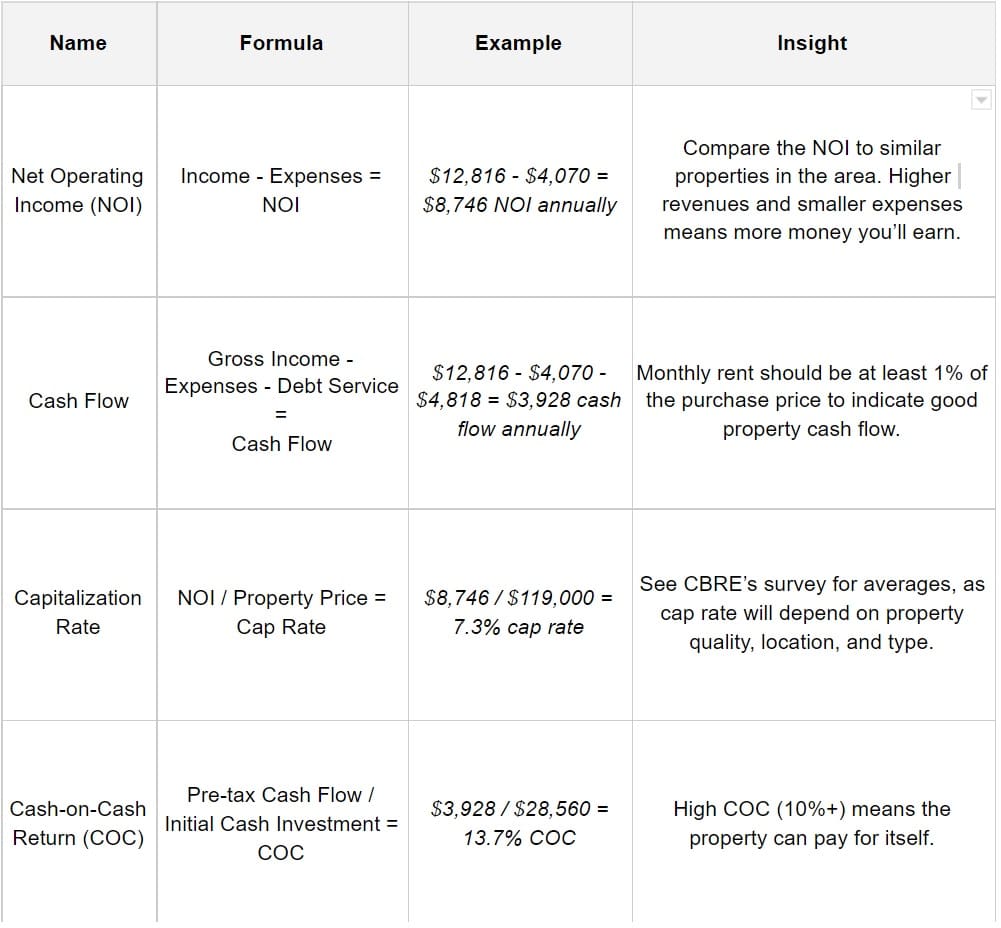

Net Operating Income (NOI)

NOI is a valuation method that shows the total income in operating the rental investment, exclusive of any debt or financing costs. It helps you determine the capitalization rate (to be discussed later on) that helps with calculating the property’s value—ultimately allowing you to compare properties based on the income they could potentially generate.

The formula is as follows:

Income – Expenses = NOI

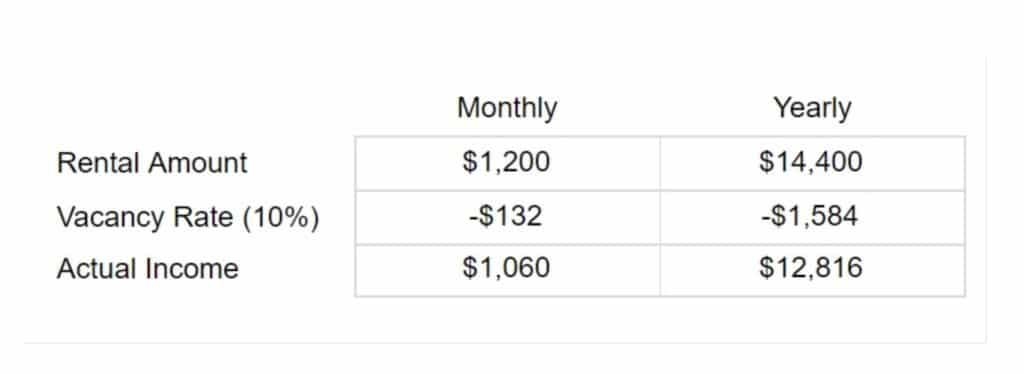

When calculating income, remember to consider the average vacancy rate of the neighborhood, as rental properties won’t always be occupied—no matter how good you are at marketing and attracting tenants. The vacancy rate will help you estimate your monthly income loss.

Here’s our calculation for the Hazel Park property:

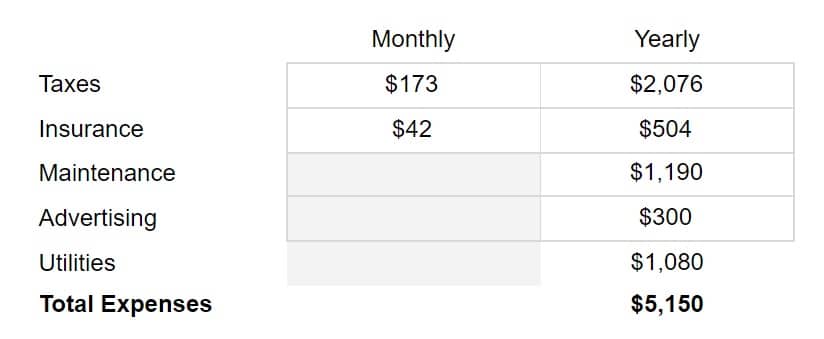

For expenses, you need to take the following into account:

With these numbers, we can now calculate the NOI:

$12,816 – $4,070 = $8,746 NOI annually

There is no particular number for a good NOI. Instead, compare the NOI to similar properties in a particular area to see if the income is too low or the expenses are too high.

Simply put, the higher your revenues and the smaller your expenses, the more money you’ll earn from the property. It’s up to you to decide which among the prospective properties are most worth it to own, maintain, and rent out.

Cash Flow

Simply put, cash flow is the amount of cash income you get less the amount of cash expenses. Compared to NOI, cash flow takes debt service into account while excluding non-cash expenses such as depreciation. NOI measures profitability, while cash flow is viewed (even beyond real estate) as a measure of financial health.

To calculate how much money you’ll pocket after paying all the bills and expenses, use the following formula:

Gross Income – Expenses – Debt Service = Cash Flow

Using our Hazel Park example, the estimated annual mortgage repayment amount is $4,818. This means you’ll pocket around $3,928 per year. This shows that if you pay in cash instead of taking out a loan, you’ll earn more from your investment.

$12,816 – $4,070 – $4,818 = $3,928 cash flow annually

A healthy, positive monthly cash flow guarantees real profit over a long period of time. This is especially important for buy-and-hold investments like rental properties, where you’ll own and operate the property anywhere from 5 to 30+ years, depending on your strategy. The value of the property will only increase, as you enjoy stable cash flow from rent month after month.

If you want a faster way of checking this when analyzing multiple deals, you can use the industry-standard 1% Rule as a starting point. This rule says that the monthly rent should be at least 1% of the purchase price to understand if the property has the potential to yield positive cash flow.

Property Price > 1% of Monthly Rent

For our Hazel Park example, the property price of $119,000 means the monthly rent should be at least $1,190. However, the rent amount is only at $1,068—falling just slightly short of the 1% rule.

Capitalization Rate

Often shortened to just cap rate, this calculation shows your property’s potential return independent of the buyer and financing a.k.a. the ROI if you paid in all cash. Cap rate is the NOI of a property in relation to the property value, which could either be the market value or purchase price.

This is important to accurately understand your operating costs and choose between investment options. You’ll be surprised just how much difference two similarly-priced properties would yield in annual ROI.

The formula looks like this:

NOI / Property Price = Cap Rate

For the property in Hazel Park, the calculation looks like this:

$8,746 / $119,000 = 7.3% cap rate

There’s no standard rate for a “good” cap rate, as it will depend on several factors such as the quality of the property, its location, and type. CBRE’s North America cap rate survey from 2019 shows that a multifamily home will be roughly 5%, which makes the home in Hazel Park quite promising.

Property class and type have a huge impact on what’s considered a good cap rate—which should influence your decision when choosing properties. The averages also help you determine if a property surpasses or falls below standards.

Cash-on-Cash Return (COC)

COC or Equity Dividend Rate determines the return and stability of an investment. The calculation measures the annual return you’ll make in relation to the mortgage you’ll pay in the same year. COC is important in forecasting the rental property’s investment performance based on expected earnings and expenses.

The formula is:

Pre-tax Cash Flow / Initial Cash Investment = COC

For our example, the calculation is:

$3,928 / $28,560 = 13.7% COC

There is no standard COC rate. Some investors are happy with a stable COC return of less than 10%, while others will only consider a property with a whopping 20%. Generally, the higher the COC rate, the more the property can pay for itself in the long run.

While COC may sound identical to ROI, the latter is quite difficult to truly calculate for rental investments. You won’t know how much a rental property will give you in total before you sell it, therefore it does not make much sense to calculate the ROI. Instead, use COC where you can accurately analyze the property’s cash return for every cash invested.

Summary of Key Calculations

Conclusion

All real estate billionaires (Donald Bren included!) understand how to analyze real estate investments before pouring their hard-earned money into properties. By mastering these key analysis methods, Marco can succeed in his venture—and so can you.

Ready to get started? Get in touch with us and we’ll guide you through your real estate investment journey.

Also, make sure to visit our glossary of common real estate terms to brush up on your vocabulary and interact with other investors like a pro!

Comment below if you have any questions.

Image courtesy of Kindle Media