Understanding Cap Rates to Gain the Highest Returns on Investment

Capitalization rate (or cap rates) is a term that real estate investors use to determine the value of an income-producing property. Unfortunately, it’s also one of those terms that cause head-scratching among some people, as it sounds like something you’d see in an accounting course rather than when talking about mortgages and properties.

So what exactly does this mean? How do you calculate it?

Cap Rates Formula

Here’s the formula for getting the cap rate of a specific property. Simply take the annual net operating income and divide it by the total acquisition cost like so:

Not sure how to use this formula? Here’s a rundown of the steps:

- Calculate your net annual income (NOI). Subtract all management, utility, maintenance, insurance, taxes, and other operating costs from the gross revenue. You won’t need to include mortgage payments for this one.

- Next, take potential vacancies into account. You’ll have to research this based on the area you’re planning to invest in. For most cases, you’ll subtract around 10% of your total annual rental income from the property.

- Lastly, divide your NOI by the total acquisition cost for the property. This includes the purchase price, brokerage fees, closing costs, and estimated repair costs. You’ll land at a single-digit that you’ll have to express as a percentage.

Definition of Cap Rates

Now, the term “capitalization” comes from finance, where it typically refers to how much money is left over after debt has been paid off. In the real estate industry, a cap rate is a ratio that shows how long it’ll take to get back the money you’ve invested in a one-year time frame.

Cap rates are often used as a baseline when comparing multiple investment properties and are comparable to the estimated rate of return on a deal. In short, it gives you the property’s unleveraged rate of return.

For instance, an all-cash property of $100,000 with a cap rate of 4.5% will offer similar returns as $100,000 invested in securities for the same cap rate. You can then choose among your options to utilize your funds according to your goals, and weed out the ones that are unfavorable.

If you’re familiar with finance, you can think of cap rates as the opposite of the price-earnings ratio (or P/E) that is often used in the stock market. While P/E measures the market value of a stock versus its earnings per share, the cap rate measures the annual income of a property versus its cost.

Comparing Cap Rates

Let’s put the calculation to good use. Let’s say the NOI of an apartment complex is $800,000, with a total acquisition cost of $10,000,000. In this case, the cap rate comes out to 8%.

Now, depending on your area, this figure could either be good or unrealistic. Depending on the investment goals, some investors will only entertain any cap rate that is at least 10% or better, while others will gladly accept anything as low as 4%.

The most important factor here is to decide what kind of return on investment (ROI) you want from the property. Do you want high monthly cash flow from rent or long-term equity gains and appreciation? There’s usually a trade-off here, where you’ll have to choose between the two.

For example, areas with high cap rates will likely have strong cash flows, but they won’t appreciate much over time. In contrast, areas with low cap rates will appreciate a whole lot over a long period—something we’re sure you’ll love when using a buy-and-hold strategy. You’ll have to know what you want.

If you’ve unlocked the additional features of Mashvisor, you can use their website to see the cap rates of each property in a specific area so you won’t have to do them yourself. Here’s an example for the City of Detroit—a piece of must-have information for Detroit property investors.

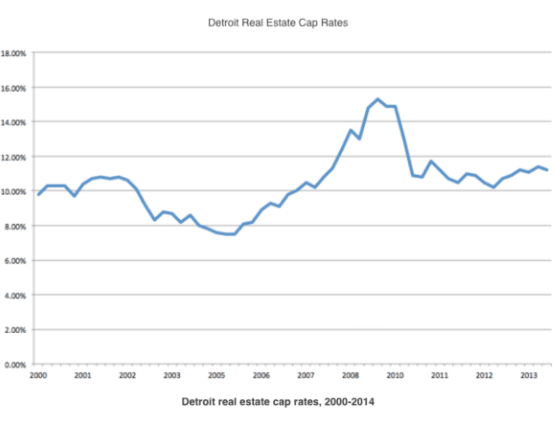

HomeUnion also provides the following cap rate trend for the City of Detroit:

Mashvisor also provides a quick overview of the cap rates by city across all property types, so you can have a glimpse of how the area compares to other major metropolitan cities:

As you can see, cap rates differ by the market as much as they do by property. Operating costs, acquisition costs, and rent amounts will vary significantly from one area to another, making it crucial for you to understand the local market with the help of agents or property management companies.

When You Should and Shouldn’t Use Cap Rates

Cap rates provide an insight into the future. It helps you see the trends in a given market, so you can make the necessary adjustments, ensuring that you garner continuous profitability of your rental property. Here are a few examples:

- You can use cap rates to measure the risk of a deal. Older properties that won’t have the best chances of attracting credit-impressive tenants will have more risk, therefore, will have a lower price and result in a higher cap rate.

- Use cap rates to control your operating costs. Since these costs are subtracted from your rental income, the calculation allows you to achieve optimum operating costs that are lower than your estimate—all to improve your cap rate result and bottom line profits.

Nevertheless, cap rates are not always applicable. Here are a few situations where you’ll have to use cap rates carefully or avoid it completely:

- Only compare cap rates that have the same costs. For instance, don’t compare one cap rate that discounts rent revenues based on vacancy rates and another that doesn’t have the same discount. You’ll have to compare apples to apples for accuracy.

- Apartment complexes are entirely different from houses. For example, single-family home values can be evaluated based on their comps (similar homes nearby that have recently sold), but apartment buildings are valued based on their profitability with respect to NOI divided by the total purchase price—also known as cap rates.

- Cap rates aren’t the best calculations for assessing short-term investments. This includes fix-and-flip projects where the objective is to sell the property as fast. Properties like these don’t generate any income from rent, so they can’t be evaluated with a cap rate formula.

- Cap rates are different from Cash-on-cash return (CoC). They are both good ways to estimate the potential profitability of an investment, but CoC takes property debt into account—drastically different from the cap rate formula.

- There is a limit to cap rates—often with investment properties that have irregular or complicated cash flows. It’s best to use discounted cash flow analysis instead for those situations, so you won’t mislead your evaluations.

In other words, cap rates are best for assessing commercial real estate properties. But never forget that other variables like the economic cycle, property value movements, and fluctuations in NOI can always shift and go against your prediction.

Also, we’re working with low-interest rates nowadays. This means cap rates are relatively low, and property values are at an all-time high, making it difficult for you to find good investment opportunities—a situation is driven by the Federal Reserve instead of the market.

Cap Rates for the Best Investment Opportunities

As you can see, cap rates are a powerful tool for making better investment decisions. The main use of the calculation is to identify which among your different opportunities offers the best investment returns.

Nevertheless, we hope that this article has helped you understand the basics of how to use them and what they mean in more detail. It’s more important than ever for you to understand the benefits and drawbacks of cap rates, so you can separate the potential opportunities from those that are overpriced.

Do you have any other questions on cap rates? If there is anything else we could do for you, just let us know in the comments section below!

Photo by Towfiqu barbhuiya