The Huge Rent Bubble in the Room that No Investors Want to Talk About, But Should

The market was doing well…until it wasn’t.

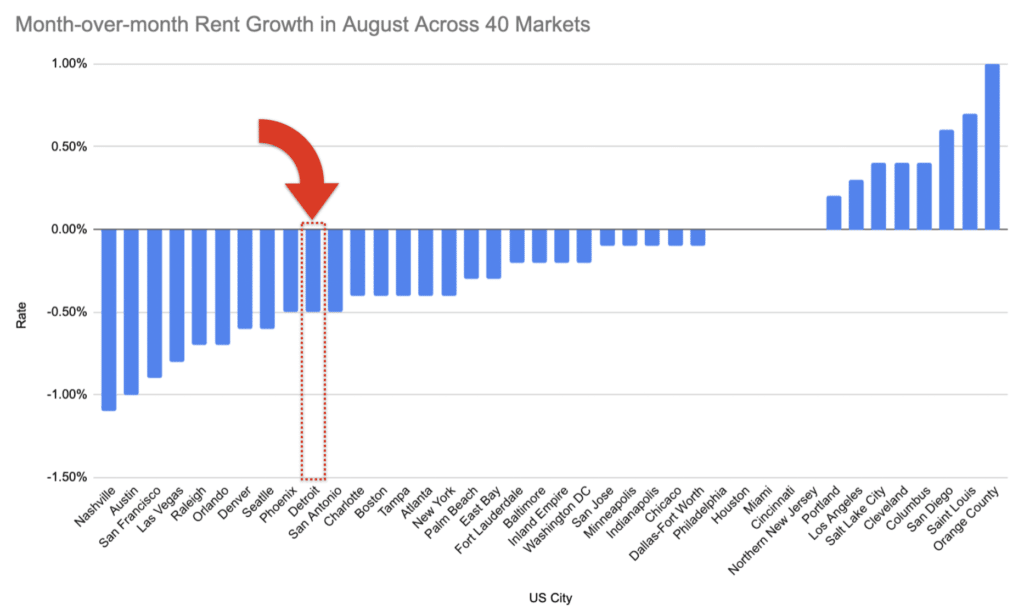

In the past 8 months, the US rental market did a complete turnaround, ending the 20-month streak of increasing rent amounts across 27 of the 40 biggest cities. Prices fell by 0.1% in August 2022, according to Apartments.com, much to every investor’s despair—and may now threaten investment returns.

So what’s left many of us wondering, what happened to the market and how is Metro Detroit affected? Let’s take a look at what you can do about it, to remain financially viable with your investments.

The Rent Decrease Bubble in the US Housing Market

The housing market went through changes in recent years. Back before the COVID pandemic, there was a shortage of housing inventory, which led to buying competition and increasing property prices. Then COVID hit and the real estate market screeched to a halt—which turned out to be temporary.

The market roared back hotter than ever as interest rates dropped and remote work became a thing. Prices soared higher as the competition got intense between homebuyers. Now, the market is cooling off due to rising interest rates and concerns about the economy turning negative.

There’s still a shortage of housing, specifically affordable housing, but builders are slowing down on new construction. Less people are buying houses, but they have to live somewhere. So either they go back to stay with their parents (which, let’s be honest, doesn’t sound great) or they rent a home.

So, what does all this mean for rent prices?

We can’t panic or try to predict the future. Instead, let’s lay out the truth and check the possibilities. We’ve monitored the market and saw that from rent averages at an 8.4% pace in the same period last year, it’s now at 7.1%. Renters, meanwhile, are celebrating financial relief, while investors and landlords clutch dearly to their investment returns.

“After a 20-month run of positive monthly growth dating back to December 2020, the market finally witnessed negative asking rent growth on a monthly sequential basis from July to August, with rents down 0.1% in July,” said Jay Lybik, the national director of multifamily analytics at CoStar Group.

“We’re seeing a complete reversal of market conditions in just 12 months, going from demand significantly outstripping available units to now new deliveries outpacing lackluster demand.”

Unfortunately, the City of Detroit is included in the list. Its market experienced a 0.5% decline in rent averages, becoming one of the most significantly affected real estate markets in the United States.

Here’s the data to show just that:

Unfortunately, we don’t know what the data counts as “Detroit”. It could be referring to just the City of Detroit or the entire tri-county area of Metro Detroit. If it’s the former and doesn’t include the more affluent area of Oakland County, the data might be reflecting only the lower economic zones, which are inevitably the first areas to get affected in an economic downturn.

In other words, if the data above only includes the City of Detroit, the data is doing the greater Metro Detroit area a disservice by skewing the numbers. And investors with properties in Metro Detroit around the City of Detroit won’t likely experience the rent decline—which is excellent news.

But if we assume that the data already includes the entire Metro Detroit space, rent prices must increase soon or we’re looking at an impending market crash in the near future.

The Best Way to Handle Rent Decrease Bubbles

For now, the Detroit market isn’t feeling the effects yet. It’ll take some time before it does. Moody Analytics even said that since 2020, almost all (89%) of the nation’s top metropolitan areas saw an uptick in rent-to-price ratios, where tenants were paying more than usual for housing (excellent news!).

Moreover, the City of Detroit has a labor shortage in the construction and maintenance industry right now. While it’s bad news for property developers, it’s excellent news for rental property investors, as the demand for the City of Detroit’s housing stock is on the rise.

Still, wise investors will be proactive and prepare for the possible continuation of rent decreases. Our team has been operating in the Metro Detroit area for more than two decades now. So we’ve come up with this list of expert tips to help you prepare for the possible, unfavorable future:

- Review your current rental properties and check if they’re cash flow positive. If not, now would be a good time to reconsider your investment strategy and increase your revenues. You can increase rent carefully, without pricing out tenants or adding more income streams.

- Diversify property types by investing in otter property classes that won’t be as affected during an economic recession or market crash. For example, Class A properties are certainly much more stable compared to Class C ones, simply because their tenants are more financially stable.

- Focus on the right investment properties, so you’re less affected when the bubble bursts. After all, a home is still a necessity whether the economy is doing well or not. Renters will still flock to your place despite a downturn if you’re in an in-demand location.

- Be proactive in creating a backup plan. Have as many reserves as you can by saving money and not falling into the temptation of making new income streams. You’ll do yourself a favor by taking the safe route while weathering the storm.

- Continue screening tenants thoroughly. If you’re dealing with extended vacancies, don’t panic and rent to a tenant that might bring more harm than good. Renting to tenants that can’t pay for or maintain your home is far more financially depleting than having a home sitting empty.

- Get in touch with our team of experts for help. We can provide you with the resources and advice you need to make sure your investments are still profitable, despite the market conditions. You’ll also be updated with the latest market news and trends, so you’ll know when things start to turn around and rent prices begin to increase again.

The important thing is to stay calm and be proactive. These are unprecedented times, after all, and we need to be ready for anything. If you have any questions or need assistance with your property, don’t hesitate to find experts for professional help.

Stay Calm and Be Proactive in the Real Estate Market

Rent decreases can be stressful, but remember that this is just a phase in the market cycle. Plus, the bubble isn’t as overinflated as it was for purchase prices back in the 2008 crash, so there is less adjustment needed. Things aren’t as drastic as they were before, but we suggest that you follow our tips above, protect your investments, and prioritize healthy returns in the long run.

Whether the City of Detroit and the greater Metro Detroit area see further rent price decreases or not, one thing’s for sure—our team at Logical Property Management is here to help you every step of the way.

Don’t hesitate to get in touch with us. We’re more than happy to assist you with your property needs.