Should You Invest in Metro Detroit Rental Properties in 2023? Here’s the Forecast.

With a new year looming around the corner, many investors are wondering where next they should invest in real estate to grow their portfolios. Investing in Metro Detroit might even be part of your new year’s resolution!

But is 2023 a good time to invest in Metro Detroit rental properties?

To help you decide, we’ve collected evidence-based trends on the Metro Detroit real estate market for your review. The information will give you an excellent starting point and grasp of today’s real estate situation in Detroit-Warren-Dearborn.

Disclaimer: The metropolitan area generally covers the counties of Lapeer, St. Clair, Livingston, Oakland, Macomb, and Wayne, but our insights will focus on the last three areas.

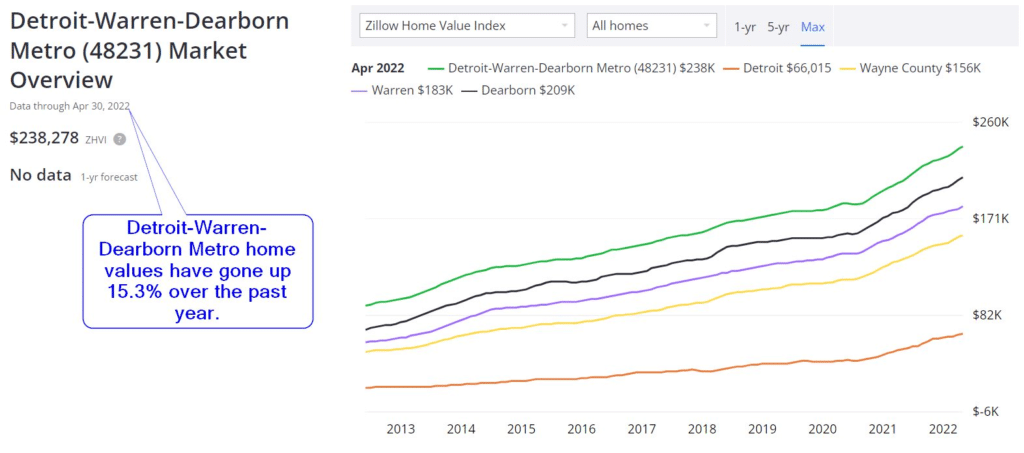

Metro Detroit Rising Home Values

The average Metro Detroit home value is $238,278, an increase of 15.3% in the past 12 months. The latest forecast also notes that the values will rise by 2.1% from July 2022 to July 2023, which means now is an excellent time for investors to hop on the train.

Recent growth is mainly due to robust housing demands and low mortgage rates, putting Metro Detroit home values on an upwards trajectory. You can see the trend in the Zillow chart below:

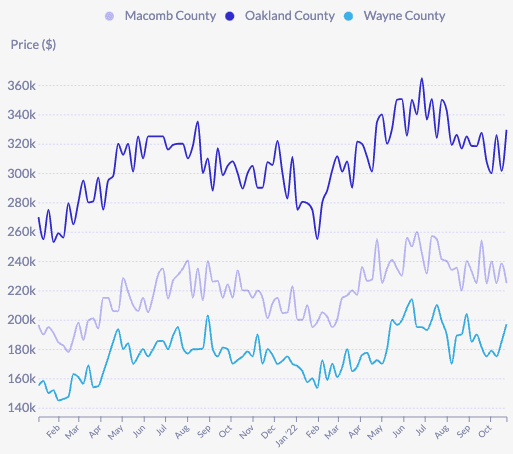

Metro Detroit Increasing Median Sale Prices

The median home price in Metro Detroit reached a record-breaking figure of $275,000—an increase of 8.5% from June 2021. In addition, listings spent an average of 16 days on the market, which is also a 3-day improvement compared to last year. Here’s a chart on median home sale prices from WXYZ Detroit:

While increased median sales price means lower buying power, it also indicates a strong buyer demand in Metro Detroit—even with high and fluctuating interest rates. In some cases, people currently pay 50% more per month if they purchased a home in 2022 compared to if they purchased in December 2021.

If you’re worried about a housing market crash, an economic forecaster from the University of Michigan, Daniil Manaenkov, said a crash is “possible but not very likely at the moment.” We have reason to believe that prices may continue to grow and settle at new heights.

Here’s a snapshot of sales price growth broken down to Metro Detroit’s three counties:

- Macomb County: Property prices reached $252,500—an increase of 14.8% compared to June 2021. Listings spent 15 days on the market, which is 1 day less than last year.

- Oakland County: Property prices clocked in at $355,000—an increase of 10.1% compared to June 2021. Listings spent 13 days on the market, which is 6 days less than last year.

- Wayne County: Property prices landed at $217,500—an increase of 17.6% compared to June 2021. Listings spent 19 days on the market, which is 3 days less than last year.

Things are looking up for Metro Detroit in terms of median sales prices as we approach 2023. So your best action is to snap up Metro Detroit properties while prices are on an upwards trend.

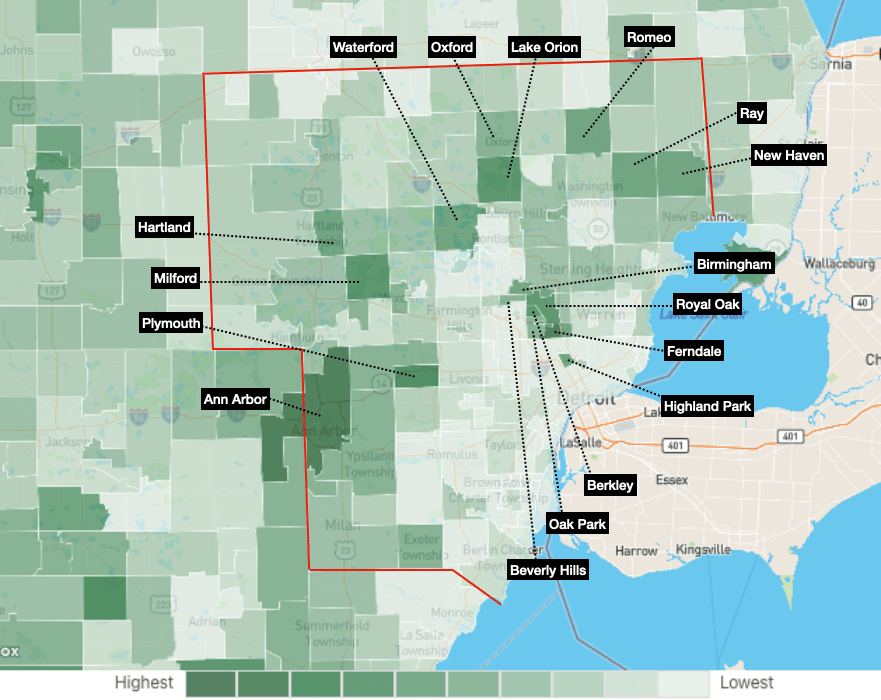

Metro Detroit Growing Appreciation Rates in 2023

Regarding appreciation rates, the typical property value in Metro Detroit appreciated by almost 154% based on Zillow’s home value index. “We’re just getting back to homes appreciating at the rate they did pre-COVID,” shared local realtor Linda Wells.

The property appreciation heatmap from NeighborhoodScout below should give you an idea of where to invest for equity gains, where you’ll see darker green areas in Macomb, Oakland, and Wayne Counties:

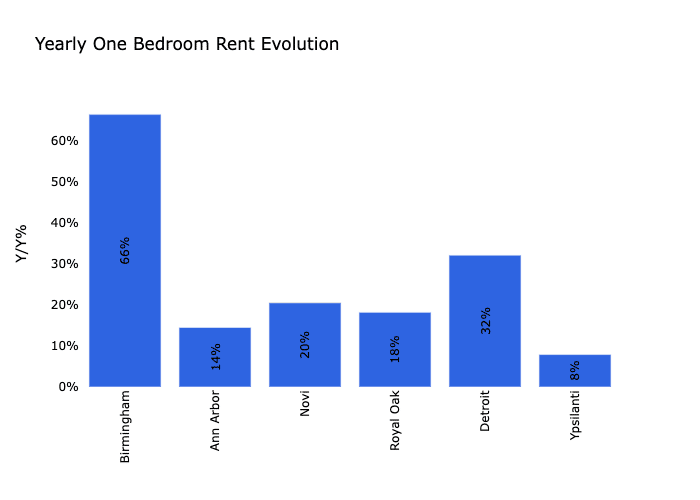

Metro Detroit Booming Rental Demand

Metro Detroit has experienced a 23% increase in rent since the start of the pandemic, which is great news for investing in rental housing. We can’t avoid the fact that we saw a slight decline in September. Still, the skyrocketing demand for rental homes and lack of housing inventory continues to create many opportunities to secure and generate strong cash flow.

Look at the chart below for the yearly one-bedroom rent evolution in Metro Detroit’s hot spots. These areas have impressive year-on-year rental demand growth, and it’s worth noting that Ann Arbor had the biggest monthly rental growth rate of 5.2%:

Should You Invest in Metro Detroit Investment Properties in 2023?

Our answer is a resounding yes.

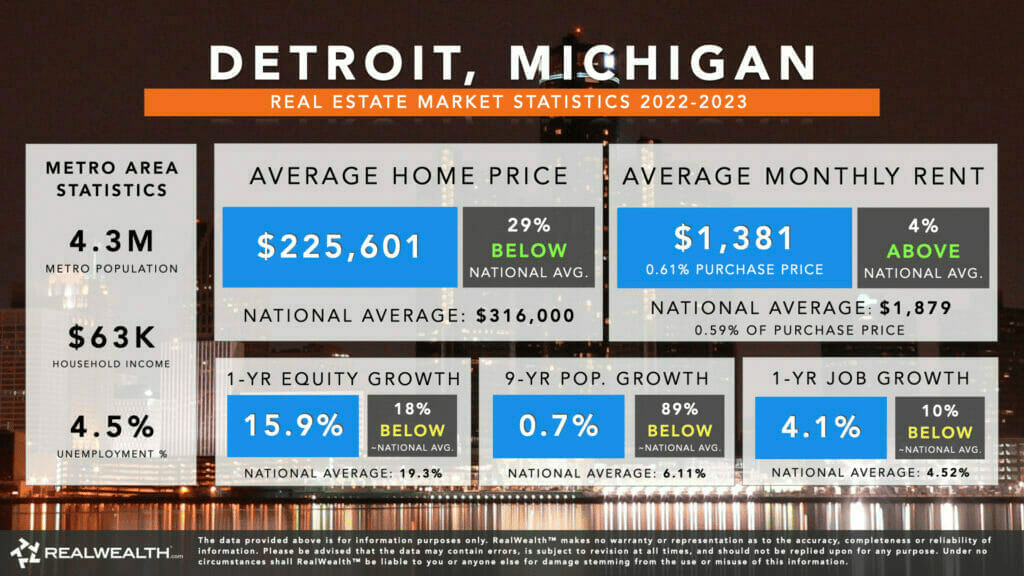

And if you’re still unsure, look at this chart from Real Wealth Network that gives a glimpse of what 2023 has in store for the City of Detroit. It doesn’t cover the entire tri-county area of Metro Detroit, but seeing where its biggest city is headed in terms of real estate should give you confidence:

Thanks to the city’s affordability and strong rent-to-price ratios (1% to 1.5%), there’s no reason why you shouldn’t bet on rental properties in and around the City of Detroit in 2023.

Population growth may be slower, but people still move here at a steady rate—mostly millennials, who tend to rent instead of owning a home. And employment is slowly but surely recovering to pre-pandemic rates, and experts predict further growth in the next few years.

Plus, investing in Metro Detroit cities surrounding Motor City effectively avoids most of the common risks associated with the City of Detroit, all while leveraging affordability. It’s a double-win situation!

Are you ready to invest in Metro Detroit rental properties next year?

We have an ongoing Deep Dive series that unpacks all the investment opportunities in every city and neighborhood in all three counties (including the City of Detroit). Find more information there!

And should you have specific questions, get in touch with our team. We’ve been operating in Metro Detroit for over two decades and have all the tips, tricks, and insider knowledge you need to succeed.