Seasonal Marketing Report (Part 2): Prepare for Tax Season’s Heightened Rental Applications

While winter is generally a slower period for rental applications, things start to pick up in the middle of February as income tax refund season gets underway. Since many Class B and C tenants live paycheck to paycheck, an income tax refund gives them the funds for the first month’s rent and security deposit they need to move.

So, as a rental property investor, you need to prepare as the busier rental season approaches and have a system in place to efficiently manage the increase in rental applications.

Let’s discuss seasonality in more detail before getting to our expert tips for handling fluctuating rental seasons.

Higher Renting Power with Tax Season

Tax season runs from late January to mid-April, with most people filing their taxes by the end of March. This period is also when most people receive tax refunds, which can be a significant sum. For most renters, this extra cash is what they need to move to a new home.

It’s especially true for those putting off a move due to financial concerns.

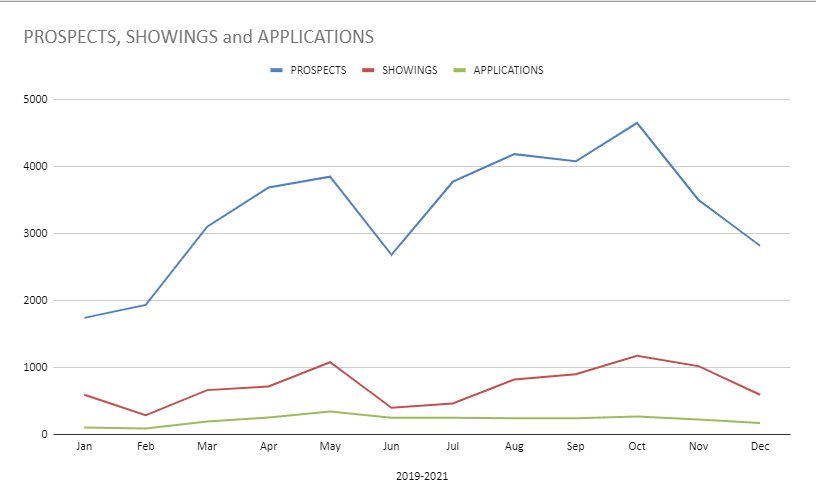

Check our 3-year seasonal marketing study and see the peak leasing season during tax times:

Moreover, you must remember that tax season is not just about tax refunds.

It’s also a time when many people are getting their first job or starting a new business. This can result in an even more significant influx of rental applications as people look for a place to live that is close to their new job or business.

Given the spike in market activity during tax season, rental property investors, landlords, and even property managers must prepare for the increase in prospects, applications, and showings before the period begins.

Now, let’s look at some tips on preparing for heightened rental activity.

How to Prepare for the Seasonal Increase

There are a few things you can do to prepare for the influx of rental applications during tax season:

- Streamline your rental application process: Ensure your method is streamlined and updated. Revise anything that takes too long, and include any new criteria you want. Doing so will help weed out unsuitable applicants and focus on those who pass your standards.

- Have a system or extra help: Use an online system or have a property management company process the applications to handle the increase. The number of applications constantly coming in might become too overwhelming to manage manually.

- Be flexible with move-in dates: Many people will want to move in immediately after receiving their tax refund, so you’ll give them a great incentive if you allow flexible move-in dates to accommodate their schedules—making you more attractive than your competition, too.

- Be prepared for negotiations: Given the competition in the market trying to get their share of the high rental demand, you have to be prepared to negotiate on the price and other terms of the lease agreement to secure the best tenants. Give yourself some wiggle room to appeal to them.

- Stay organized: With a larger volume of applications to deal with, it’s important to stay organized and keep on top of things. This means having a system in place for tracking applications and keeping all relevant information readily available.

Follow these tips so you’re prepared for the increase in rental applications. Be proactive and take these steps to streamline the process, have a system in place, be flexible, and be prepared for negotiations—all while being organized to deal with the influx due to tax season.

How to Deal with Fluctuating Rental Demands

Now, due to the dynamic nature of the market, there can be many fluctuations in rental demands. This is especially true for rental properties located near major businesses or firms that hire seasonal workers. So it’s crucial to learn how to prepare and deal with such changes.

There are a few things you can do to help manage tenant fluctuations:

- Have a flexible pricing strategy: Whether it’s to have dynamic pricing that changes according to demand or to offer discounts to tenants who are willing to move in during off-peak times, having a flexible pricing strategy will ensure that you stay profitable in all seasons.

- Have a flexible lease agreement: In addition to having a flexible pricing strategy, you should also be prepared to be flexible with other aspects of your rental agreement. This could include being willing to negotiate on the length of the lease or the number of occupants.

- Offer move-in incentives: Another way to deal with fluctuating rental demands is to offer move-in incentives. This could involve offering a discount on the first month’s rent or providing a furniture package for those who sign a lease during off-peak times.

- Have a backup plan: It’s always a good idea to have a backup plan in place in case you are unable to find a tenant. This could involve working with a professional property management company or listing your property on a short-term rental site.

Market fluctuations are here to stay. But that doesn’t mean you have to accept the vacancies you might get during off-peak seasons. Instead, get creative and be flexible enough to meet the demands of the market without compromising your rental business. You’ll find tenants even during the slowest times.

Preparing for Tax Season’s Rental Application Spike

Tax season is when renters have the finances to find better homes. Therefore, rental property inventors must know how to seize the moment—get the most applications and rent out the property to the best tenants in the highly motivated pool. This is your chance to secure quality renters for years to come.

Do you need an extra hand to manage new tenants? Get in touch with our team today. We have two decades worth of insider knowledge (just like the chart above!) to get you on the right track.

Click on the links below to read the rest of this series!

- Seasonal Marketing Report (Part 1): How to Deal with Cold Weather Vacancies

- Seasonal Marketing Report (Part 3): Leveraging School’s Out Season’s Peak Rental Applications