Rent or Own a Home? 4 Questions to Help You Decide

Ah, the American dream. Start a family, generate wealth, and own a home.

Unless you’ve been living under a rock, you probably have the notion of homeownership being the ultimate goal to lifelong happiness. Real estate agents, mortgage lenders, and even home improvement stores bombard us with the glamor of homeownership. They say you shouldn’t have to “burn money” on rent payments anymore, and your family deserves a backyard to enjoy with friends and neighbors.

However, owning a home isn’t necessarily better than renting, and renting isn’t as simple as it may seem. There are pros and cons to each, and you should be aware of them to make a well-informed decision that matches your personal goals and situation.

In this article, we’ll show you the advantages and disadvantages of renting vs. buying. We’ll also provide you with a list of questions to ask yourself before making your final decision.

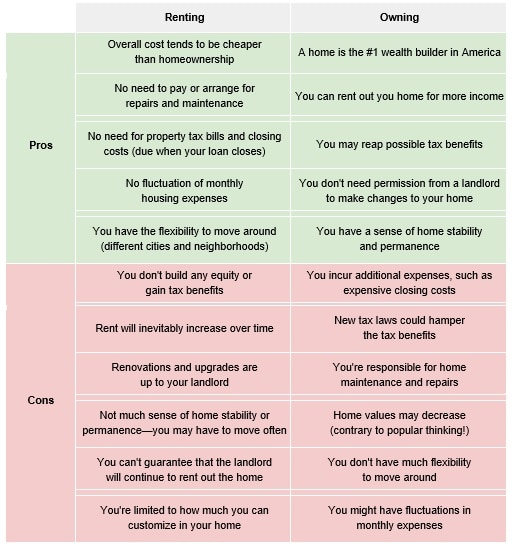

Pros and Cons of Renting vs. Owning a Home

Here’s an overview of the main differences between renting and owning. Depending on what you want to prioritize, these points might vary in significance for you:

Depending on variables, such as your work and income, you need to weigh these differences and see which one better suits your circumstances. For example, if you’re young and want to chase career opportunities, perhaps renting is the better option. But if you want to have a stable living space to start a family, owning a home would be ideal.

Whichever decision you’re leaning towards, keep your initial thoughts in mind as we go through the questions you need to ask yourself before committing to one or the other.

4 Questions to Ask Yourself Before Deciding

No one can give you a straight answer regarding renting vs. buying. But if you answer these questions to the best of your ability, it can guide you towards the right decision that fits your lifestyle and financial situation.

1. How long will you stay in the location?

Most people want to prioritize their careers. This means they may want to rent to have the flexibility of relocating when they get a new opportunity. or they may buy a home in a location that offers career growth for the foreseeable future.

If you plan to move within a year or two, renting might be better. Buying then selling a home in that period might come at a loss, especially once you consider the closing costs, moving costs, and renovations needed to sell at top dollar.

2. What is your financial situation?

Buying requires significant capital, as most of us know already. First, you need a hefty down payment before you can buy. Then there are closing and moving costs, property fixes and maintenance, mortgage payments, property taxes, homeowners insurance, and other fees. Not surprisingly, renting is much easier on the pocket if you’re prioritizing short-term finances.

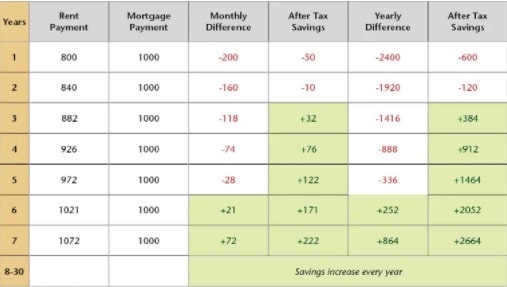

That being said, if you can deal with the upfront costs of buying, owning will be cheaper six years down the line (assuming that rent increases 5% year-on-year) thanks to lower mortgage payments:

3. Are interest rates low enough?

With interest rates hitting an all-time low due to pandemic-related changes in the economy, it may be more sensible to buy instead of renting a home. You won’t just be buying a home, but also buying at the rate at which you’re getting the loan.

The current rate as of early 2021 is 2.73%—hovering around record lows:

With 2.73% interest rates, you can buy a home worth $949k if you’re able to pay $3k monthly. Here’s a chart that shows your buying power concerning interest rates and mortgage payments:

If you can afford monthly mortgage payments on top of other homeownership costs, now is the best time to snatch that beautiful single-family home that you never thought was within budget.

4. What is the Price-to-Rent Ratio?

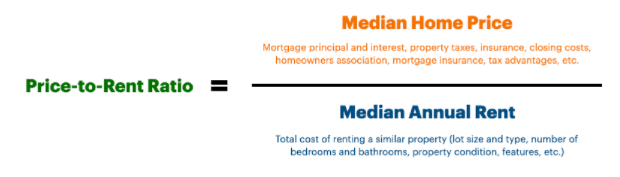

Trulia has come up with a handy price-to-rent index to estimate whether it’s cheaper to rent or buy in a city, neighborhood, or with a specific property. Of course, it doesn’t consider the affordability of either option, but it does compare the economics of renting vs. buying.

To use Trulia’s thresholds, first use this formula to calculate the price-to-rent ratio:

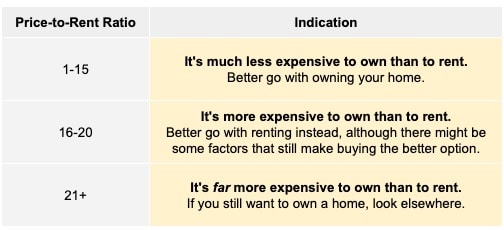

Once you have your ratio, here is the index Trulia has provided:

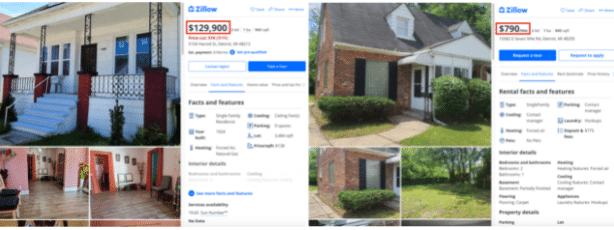

For example, let’s pull up some current listings on Zillow:

With a property price of $129k and the average rent of $790 for a similar property, the ratio comes out as 13.7. This ratio means it’s better to buy a property than rent in this area.

I’ve done a quick calculation, but I advise that you go into the specific factors that make up the home price and annual rent when you have a property or location in mind.

Conclusion

The questions we pose here all boil down to one thing: Are you willing to financially and emotionally invest in a home for at least five years? If the answer is no, then renting might be the better option. If the answer is yes, then welcome to the world of homeownership!

We hope that this information helps you decide whether buying or renting is right for you. In my opinion, the American dream means having the ability to choose according to your own interests—whatever that might be.

What made you decide whether to buy or rent? Share with us below.

I would like to see if I could rent to own

The most common reason people want to rent-to-own is that their credit does not allow them to qualify for a mortgage.

If that is the case, then what is your plan to fix your credit, so that you can qualify for a mortgage within 2-3 years?

Otherwise, you risk losing whatever investment you make in a rent-to-own transation.