Do You Need Renter’s Insurance and is it Worth it?

If you think renter’s insurance isn’t necessary, think again! Most people skip out on renter’s insurance because they incorrectly assume that:

The landlord’s policy covers them. But landlord’s property insurance only covers the losses to the building—not your belongings, property damages, or potential legal costs.

They underestimated the value of all their possessions combined. Try to calculate the value of your clothing and electronic devices alone, then you’ll see how it quickly adds up.

They overlook the possibility of being held liable. Even something as simple as your pet dog biting your neighbor can result in a serious and expensive claim.

Because of these assumptions, only 41% of renters have renter’s insurance (compared to 95% of homeowners with homeowner’s insurance). Little do they know, purchasing a renter’s insurance policy is worth it, even if your landlord doesn’t require it (and many of them do).

Today, we’ll help you understand the reasons why you should get insured as soon as possible.

5 Reasons Why You Should Get Renter’s Insurance

Having a renter’s insurance policy helps you save significant amounts of money in the event of an unfortunate circumstance. Its primary role is to protect your personal belongings, handle property damages, and provide liability coverage in case injuries happen in your house.

Here are 5 reasons why you should get renter’s insurance:

It’s Affordable: According to the National Association of Insurance Commissioners (NAIC), the average renter’s insurance policy costs $180 per year. This number is only a rough estimate, as your cost will depend on other factors like the type of coverage you choose, how much coverage you need, the deductible amount, and where you live.

Covers Losses to Personal Belongings: These can include your clothes, electronic devices, jewelry, and furniture. When something is damaged or stolen, replacing it can be expensive, especially if multiple items are lost or destroyed.

But a standard renter’s policy already protects your belongings from perils such as:

a. Damages by aircraft and vehicles

b. Damages by explosions, falling objects, and smoke

c. Damages by natural disasters (e.g. fire, lightning, volcanic eruptions, and windstorms)

d. Damages by riots or civil commotion

e. Damages by theft, vandalism, or malicious mischief

f. Damage from water or steam (e.g. from household appliances, plumbing, HVAC systems, or fire-protective sprinklers)

Standard policies do not cover certain disasters like floods and earthquakes, so you’ll need a separate rider to include things like wind damages in hurricane-prone areas. Moreover, renter’s insurance does not cover losses caused by your negligence or intentional acts (e.g., if your house caught fire due to a misplaced lit cigarette).

Still, even the standard renter’s policy already covers a variety of circumstances that can happen at any time.

Offers Relocation Expenses: If your home becomes uninhabitable due to a covered peril (like the ones listed above), a renter’s insurance may offer “additional living expenses” to help you live somewhere else temporarily. It’ll cover the cost of lodging, food, and other essentials.

Policies vary in length of coverage for additional living expenses and have a maximum amount. Even so, the availability of a “plan B” protects you from unforeseen disasters.

Provides Liability Coverage: A standard renter’s insurance includes liability coverage to protect you if someone gets injured in your home or if you accidentally injure someone else.

The insurance will pay court judgments and legal expenses up to their limit. The typical policy offers $100,000 and a small amount for medical expenses (e.g., ambulance rides in emergencies).

If you often have other people in your home or if the value of your belongings exceeds $100,000, you can request and pay for higher coverage limits to meet the total value of your assets.

Landlord Might Require It: Finally, some landlords require their renters to have renter’s insurance and expect proof of purchase. It’ll either be the landlord’s idea or a requirement by their insurance company.

Renter’s insurance is a smart way to protect yourself and cover the costs of unexpected expenses. In the event of a major disaster, your renter’s insurance will cover the damages above its premium cost, meaning it could actually save you money in the long run.

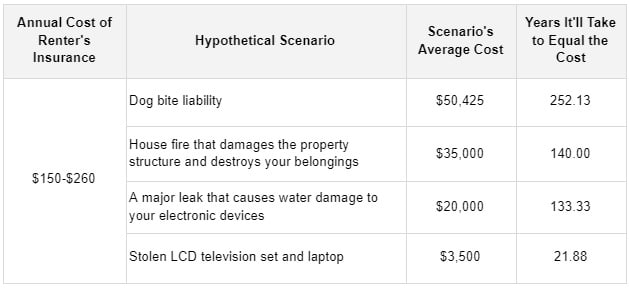

Here are some hypothetical situations to illustrate what we mean.

Key Reason Why Renter’s Insurance is Worth It

Say your dog bites someone, and you’ve been found legally liable for the injury. The average cost for a dog bite claim in the US is $ 64,555 as of 2023. If you don’t have renter’s insurance to cover liability costs, you’ll have to pay the whole amount yourself.

On the other hand, if you’ve been paying $200 annually for renter’s insurance with $100,000 in legal liability coverage, it’ll be much easier to cover an expensive dog bite claim.

To put things in perspective, you’ll need to pay $200 every year for more than 252 years to equal the average cost of a dog bite claim! This is just one simple scenario. Throughout the course of your tenancy, you may experience more expensive situations relating to property damages and liabilities.

Here’s a simple chart to show the cost of a few hypothetical scenarios:

Even if you’re well-off and have the savings to replace all your belongings and cover legal liabilities, this chart shows that it only takes one claim for your renter’s insurance to be well worth the investment.

Conclusion

Break-ins and unpredictable weather events can happen at any time, and it’s smarter to be prepared instead of diving into your savings. Renter’s insurance allows you to pay for costly, unexpected damages at an affordable cost.

Whatever happens, you’ll have peace of mind knowing that your insurance will keep you covered.