Are You Financially Ready to Rent? 7 Important Costs to Consider When Renting

While the American dream is to own or rent a home is its own significant feat in most of our lives.

Whether you’re a college student who just moved out of your parent’s home or a small family who hasn’t found the perfect opportunity to become homeowners yet, renting offers a great way for you to start living in a space you can call your home.

However, renting does come with a lot of costs that many people don’t realize. We often stop at the rent amount and forget that there are also utility bills and all sorts of deposits. Forgetting to budget for these costs will make it increasingly difficult for you to meet payments and enjoy your new home.

Let’s take a closer look.

7 Important Costs to Consider When Renting a Home

We’ve created this list for you to check off—a handy guide to ensure that you’ve covered all the costs associated with renting, so you can budget your funds and live without worries in your new place.

Go through each point thoroughly and keep them in mind while you hunt for your ideal rental home.

1. Will you rent from a rental agent?

You can always approach private landlords directly on websites like Zillow. But there are also real estate agents out there who can help you find a great place to rent, especially if you’re looking in a highly competitive market like New York or Los Angeles.

These agents have access to far more listings than you can see on Google searches, as they can check multiple listing databases (MLS) and unlisted units. They also have in-depth knowledge of the local market and can negotiate better terms with landlords, so you get the best deal possible.

However, it comes at a cost. Some agents will collect a commission or finder’s fee for either you or the landlord that’s usually around one month’s rent. You might find some that charge a flat fee of a few hundred dollars, but that might come with fewer services.

There’s no right answer to this. You just have to evaluate if you need an agent to help you find a rental and if the cost of that is within your budget.

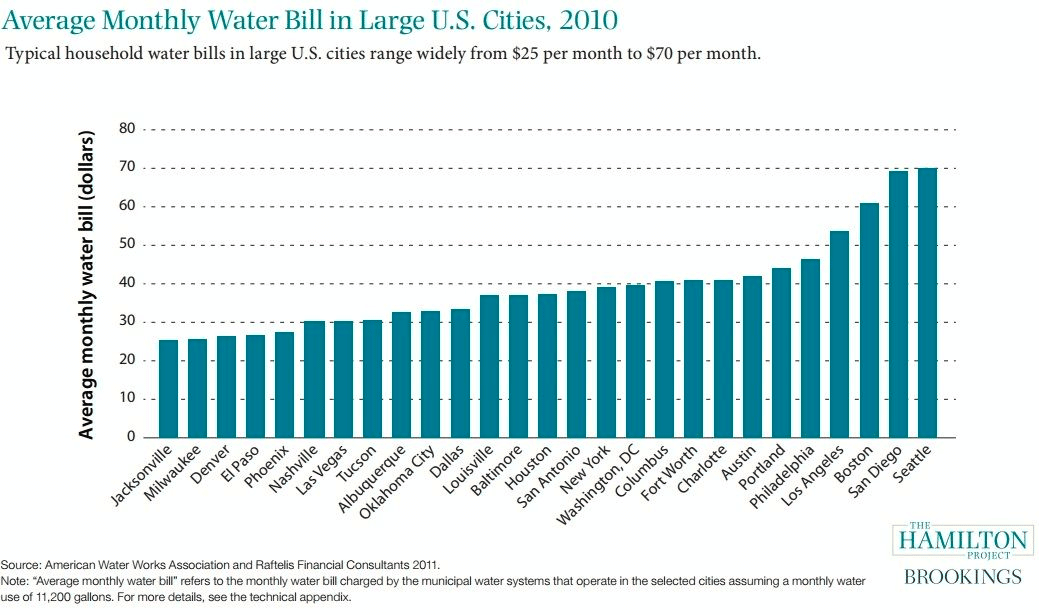

2. Is water usage included or separately billed?

Utilities are usually the second biggest expense next to monthly rent. Part of your utilities is your water usage, which the landlord will often charge in one of these two ways:

- Stipulated Water Usage: If water is included, ask how much water you can use before you’re charged with additional usage. Your lease agreement should have the details of this threshold.

- Excluded Water Usage: If there is no water usage included in the contract, you’ll have to apply for the utility in the local municipality or town council and pay for your monthly usage. You’ll also have to pay a deposit that the landlord will keep in an escrow account until you move out.

The last thing you want to happen is to rent a home thinking that you have a water usage allowance, when in fact, you have to coordinate and pay for the utility yourself.

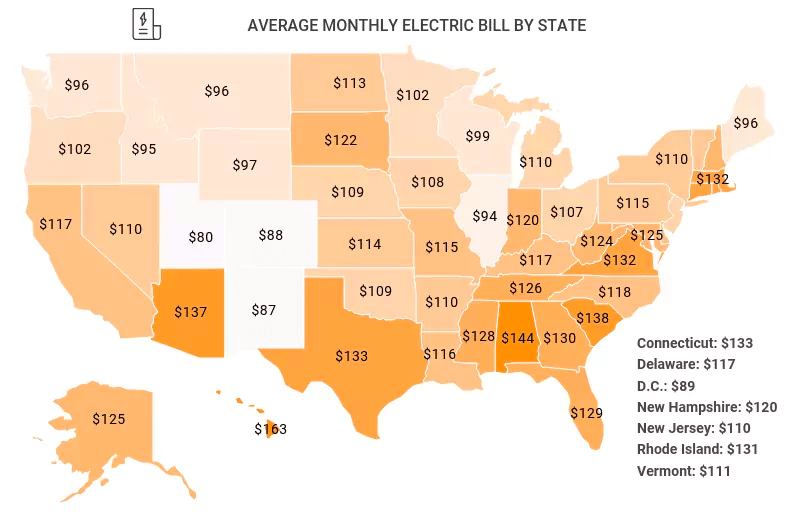

3. Is electricity included or separately billed, too?

Just like water, you also have to ask about electricity bills.

Most properties will require that you pay a utility deposit for electricity before signing the contract. And some rental properties will have “prepaid energy,” which means you have to pay for the upcoming month’s electrical usage in advance. You’ll have to budget for this, so you’re not caught off guard.

If you want to save on energy, you can ask the landlord if it’s possible to replace electrical kitchen appliances with gas-based ones, so it’s more affordable for you. You can also ask if they can replace the warm water geyser with gas- or solar-powered ones for the same reason.

Should you need more tips on lowering your electric bills, check out our articles on saving up in the summer and in the winter for better use of your funds.

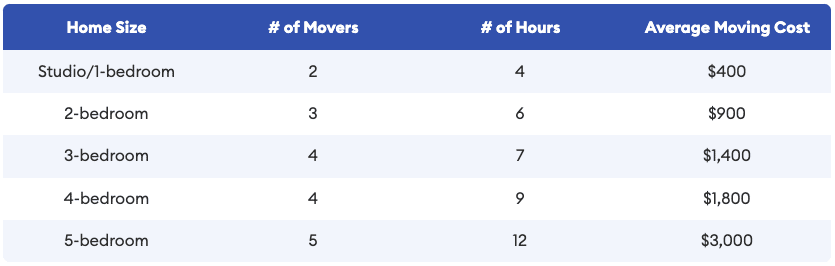

4. Will you hire professional movers?

While many people opt to leverage the kindness of their friends and family, there are situations where you might need to hire a professional moving company instead, such as the following:

- If you’re moving cities or states

- If you have a lot of things to move

- If you want to move your things as fast as possible

- If you want expert handling of your personal possessions

Should you decide to hire professionals, take note that the national average cost for moving is $1,400 or within the range of $800 to $2,150. At this cost, you’ll have two professionals relocating your things to a place within 100 miles, often still a local area in the same state.

If you’re moving to a place more than 100 miles away, the average cost will catapult from $2,200 to $5,700. This is a huge cost to consider, even if it’s only a one-time fee.

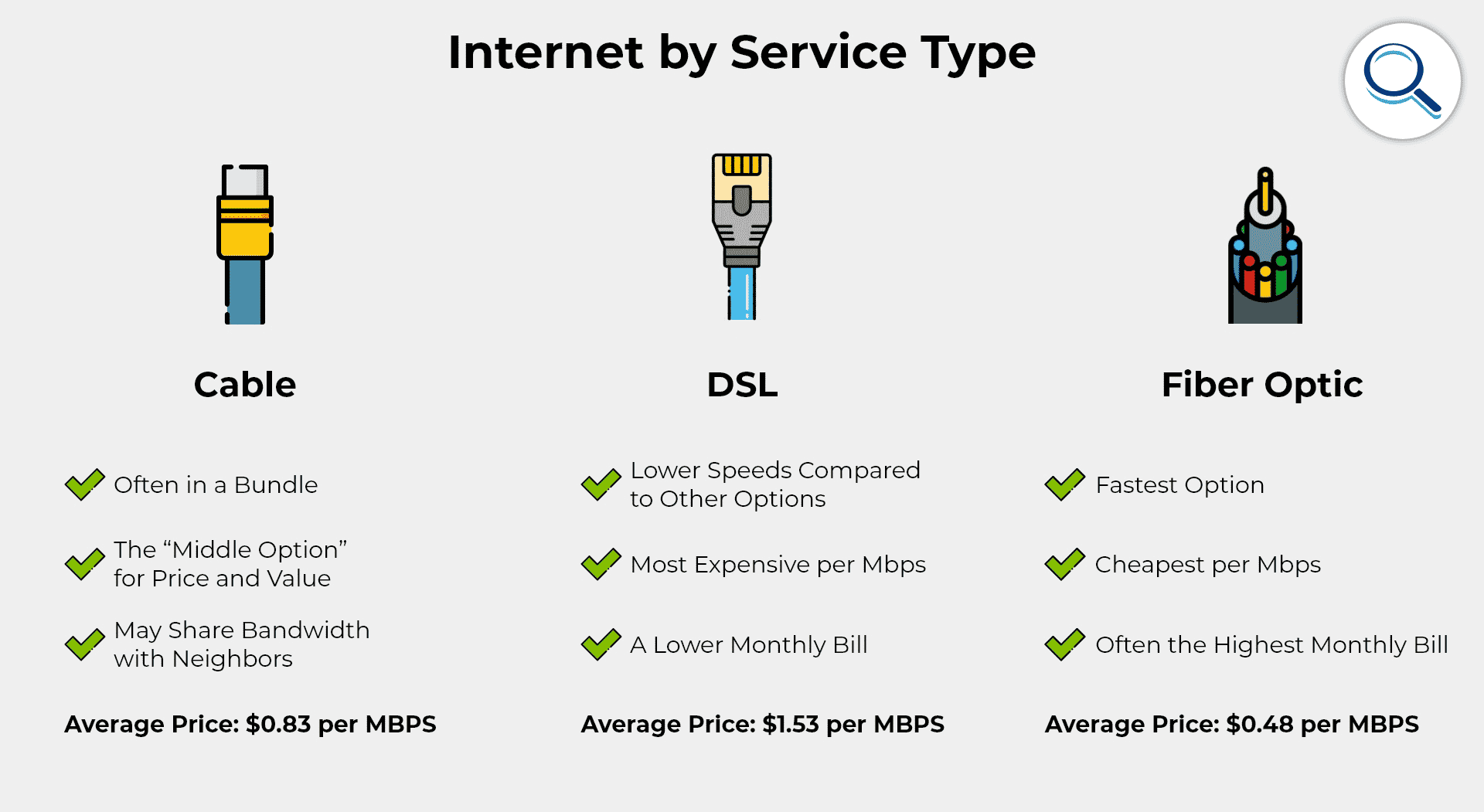

5. Will an internet connection be included in the rent?

In this modern day and age, nobody can live without a good internet connection—not even our grandparents! So ensure that you ask if the rental property comes with WiFi. The home may come with a router and all necessary equipment, but the landlord may still expect you to pay for the connectivity.

We suggest that you scout for the best prices from local suppliers before you move in, especially if you are working from home or have smart appliances that will need WiFi. Moreover, consider the type of connection you will need:

- Cable: Widely available and charged by Mbps, usually more expensive along the East Coast

- DSL: Generally more expensive, but cheaper in Midwest regions and the Great Lakes

- Fiber Optic: Cost-effective especially in major metropolitan areas

6. Are there any pet and pest control deposits?

Aside from the security deposit, your landlord may charge pet and pest control deposits as well.

If you plan to bring a furry friend with you, there might be pet deposits or fees that you’ll have to allocate your budget for. This may be a one-time fee ranging from $100 to $300, but it may also be an additional monthly charge on top of the rent amount.

Landlords do this to protect their property, ensuring that they have the funds to repair any pet-related damages done to their investment property.

In the same way, landlords may also charge pest control deposits or fees to maintain the home and encourage you to take care of the property a bit better. Preventive measures will typically cost around $50 to $100 per month, depending on the coverage and methods used.

They’ll also fumigate the property once you’ve moved out so it’s fresh and clean for their next renters.

7. Are there extra charges for parking, garage, or storage space?

How big is the rental property? Does it have adequate space for all your things, including your car?

If you’re moving into an apartment unit, chances are, you’ll have to pay extra fees for covered parking slots, a lock-up garage, or additional storage space. Here’s a quick snapshot of what to expect:

- Parking Fees: Generally, apartments near business districts have more expensive parking fees of around $150 to $500 per month, while suburban areas will usually charge a maximum of $75 per month. If you’re renting in a rural area, however, parking might just be completely free.

- Storage Fees: Renting a storage unit will cost around $100 to $300 a month, depending on the size and availability. You can opt to rent from storage units online so it’s around 20% cheaper, but it’ll still weigh on your monthly budget if you plan to store things long-term.

Note that these are all averages based on large databases, and your landlord might have different solutions and rates for you. Remember that it doesn’t hurt to ask how much these things will cost even if you don’t initially plan to acquire them, as you’ll never know when you might need additional space.

Renting Costs Beyond Rent Amounts

Be well informed of all the costs associated with renting a home, so you can avoid as much financial stress as possible. The things we’ve listed should also help you determine whether you can truly afford to rent the home because once you sign your name on the dotted line, there is no turning back from paying all the expenses that come with it.

The more prepared you are with your budget and finances, the better your experience will be in finding your next home. After all, moving to a new place should be a fun and enjoyable experience! It should not put a strain on you that’ll only build up with each month.

Do you need more help in finding a new place to call home? Our team of expert property managers is more than willing to guide you in your journey. Get in touch to learn more.